Investment Thesis

I take a bullish view on Carrefour SA and see the recent price decline as a potential buying opportunity.

In a previous article back in November, I made the argument that Carrefour SA (OTCPK:CRRFY) needs to see further earnings growth in spite of resilient sales performance – and accordingly rated the stock as a hold at the time.

Since my last article, the stock is down by nearly 14%:

TradingView.com

The purpose of this article is to determine whether Carrefour SA has the capacity to rebound from here, taking recent performance into consideration.

Performance

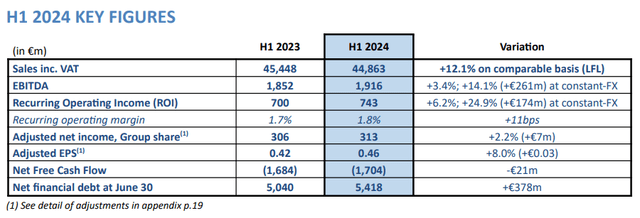

When looking at H1 2024 financial results for Carrefour SA as released on July 24, 2024, we can see that H1 2024 sales were up by 12.1% on a like-for-like basis as compared to the previous half-year period, with a 10.8% like-for-like increase for Q2 2024.

Carrefour SA: Q2 2024 sales and H1 2024 results

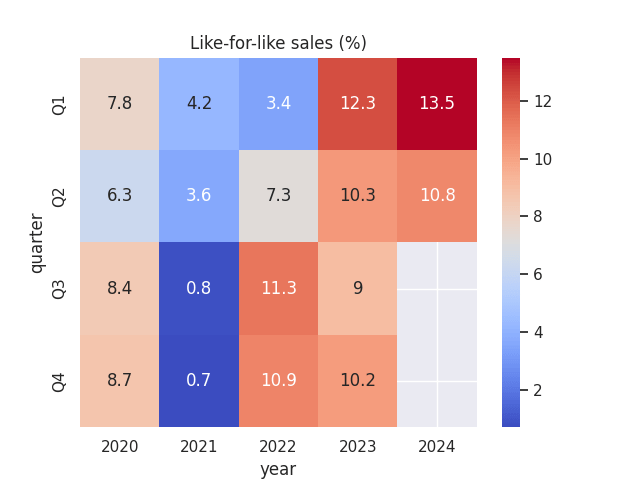

We see that like-for-like sales in Q2 2024 was up by 0.5% from that of the prior year quarter, while LFL sales in Q1 2024 came in at the highest level seen across all quarters from 2020 to the present.

Figures sourced from historical Carrefour SA quarterly earnings reports. Heatmap generated by author using Python’s seaborn library.

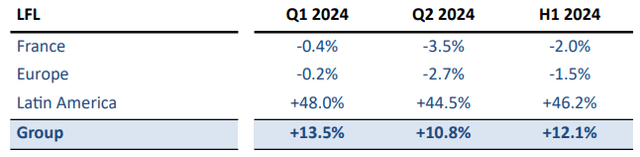

With that being said, we can see that this has been primarily due to growth across the Latin American market, with growth of 44.5% in LFL for Q2 2024. In contrast, France saw a -3.5% decline in LFL sales for Q2 2024.

Carrefour SA: Q2 2024 sales and H1 2024 results

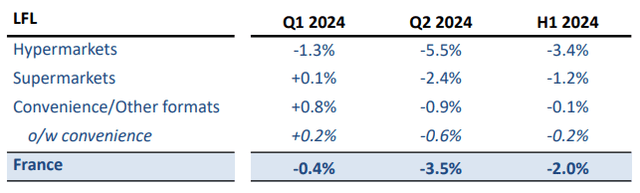

When analysing the French market in more detail, we can see that hypermarkets saw the biggest drop in LFL sales of -5.5%.

Carrefour SA: Q2 2024 sales and H1 2024 results

This is primarily a reflection of the slowdown in inflation in the context of a market where volumes have been remaining slightly on the negative side.

I had previously pointed this out as a potential risk for Carrefour – sales have been significantly price-driven rather than volume-driven in an inflationary environment. We are now seeing that with the easing of inflation – particularly across the European market – this has accordingly been placing downward pressure on sales growth.

However, it is also notable that recurring operating income for the French market was up by 6.2% to €286 million for H1 2024, with pricing investments having been offset by strong cost-saving momentum.

My Perspective and Looking Forward

In my view, prospects for Carrefour SA going forward will hinge significantly on how the company’s sales performance evolves as inflation starts to reverse.

We have seen that growth in sales has been largely price-driven up until now, but this cannot be sustained indefinitely, and we will need to see volume growth pick up going forward.

I take the view that this is a possibility for the company going forward, as Carrefour continues to significantly expand in the French market – with the company having already integrated 23 ex-Casino stores and also having acquired 60 Cora hypermarkets and 115 Match supermarkets – with all Cora stores set to be trading under the Carrefour brand by the end of this year.

With 166 new convenience stores having joined Carrefour in H1, and at least 200 additional stores set to open in H2 – this would mark a record number of franchise openings in one year. Under this scenario, I take the view that Carrefour would have the capacity to significantly boost sales volume as a result of a more extensive store network, which would counteract the effects of downward price pressure.

In addition, the Brazilian market continues to perform strongly – with the company having seen ROI growth of 45.7% to €366 million. E-commerce growth has particularly strong, with GMV up by 46% in H1. It is also notable that e-commerce growth across all markets was particularly strong – up by 30% versus H1 2023.

Broadly speaking, Carrefour SA is in a good position to meet its 2026 plan initiatives, with e-commerce growth continuing to bolster the company’s digital footprint, as well as continued expansion of the Eureca purchasing platform, with an estimated 30% of national brand procurement set to be centralised at the European level – putting Carrefour on target for its goal of 50% by 2026.

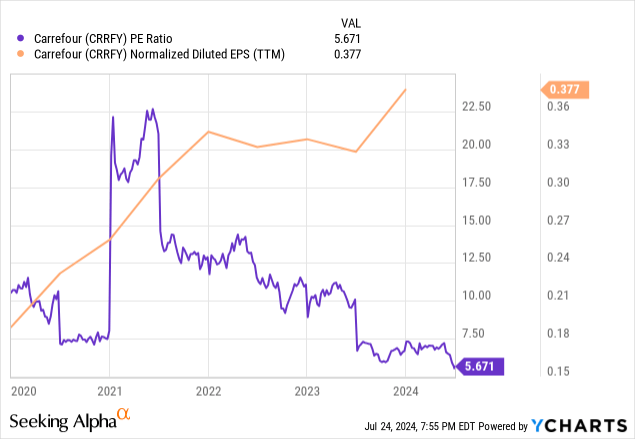

From an earnings standpoint, I had previously asserted that given the P/E ratio has been weakening since 2021 along with earnings growth continuing to climb – a terminal P/E ratio of 10x to 15x would be more reasonable given the range seen in 2021 and 2022.

Since then, earnings per share has continued to climb to $0.377.

ycharts.com

My previous calculation of fair value was based on a previous earnings per share of $0.356 with an estimated fair value range of between $3.50 (10 * 0.356) and $5.34 (15 * 0.356).

At a current EPS of $0.377, I now estimate fair value to lie between a slightly higher range of $3.77 (10 * 0.377) and $5.655 (15 * 0.377).

In this regard, given the strong growth in e-commerce, store expansion across the French market, and impressive performance across Brazil – I take the view that earnings growth has the capacity to continue climbing and take a bullish view on the stock. I envisage that Carrefour SA has the capacity to see growth to the fair value range of $3.77 and $5.655.

Risks

In my view, the main risk for Carrefour SA at this time is the possibility that downward price pressure may continue to outpace volume growth across the French market. We have seen that store expansion has continued across France, and the company will be increasingly dependent on volume to ultimately sustain overall sales growth – given both lower inflation and increasing price competitiveness among its peers.

With that being said, I take the view that Carrefour’s continued store expansion across the French market puts the company in a good position to bolster sales volume over the longer-term. Moreover, continued strength in e-commerce sales and strong growth across the Brazilian market has continued to lift overall earnings, and I see this trend as having the capacity to continue from here.

Conclusion

To conclude, Carrefour SA has continued to show impressive earnings growth in spite of downward pressure on like-for-like sales across the French market – and I take the view that continued store expansion across this market has the capacity to bolster sales growth over the medium to long-term. On this basis, I now take a bullish view on Carrefour SA and see the recent price decline as a potential buying opportunity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here