I’ve covered the WisdomTree U.S. Efficient Core Fund (NYSEARCA:NTSX), a 1.50x leveraged balanced fund, several times in the past. I’ve generally been bullish, as the fund’s strategy should result in higher returns and lower drawdowns. Inflation is NTSX’s Achilles’ heel, with the fund seeing significant underperformance during inflationary periods, most recently 2022. With inflation finally vanquished, the fund should see above-average returns at below-average risk moving forward and is a buy.

NTSX – Basics

- Sponsor: WisdomTree

- Dividend yield: 1.12%

- Expense Ratio: 0.20%

- Leverage Ratio: 50%

NTSX – Strategy Overview

I’ll start with an explanation and investment thesis of more traditional balanced funds before taking a look at NTSX itself.

Traditional balanced funds invest a portion of their assets in equities, a portion in treasuries. 60/40 splits are common.

Balanced portfolios are effectively always safer, less volatile than those investing exclusively in equities, partly due to asset class diversification, partly because treasuries themselves are safer, less volatile than equities. Drawdowns are generally lower, too, as treasuries tend to outperform during downturns and recessions.

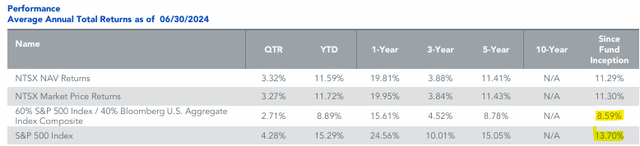

Balanced portfolios almost always underperform equities, as treasuries are lower-return investments compared to equities. As an example, traditional balanced portfolios have underperformed the S&P 500 by over 5% per year since the fund’s inception.

NTSX

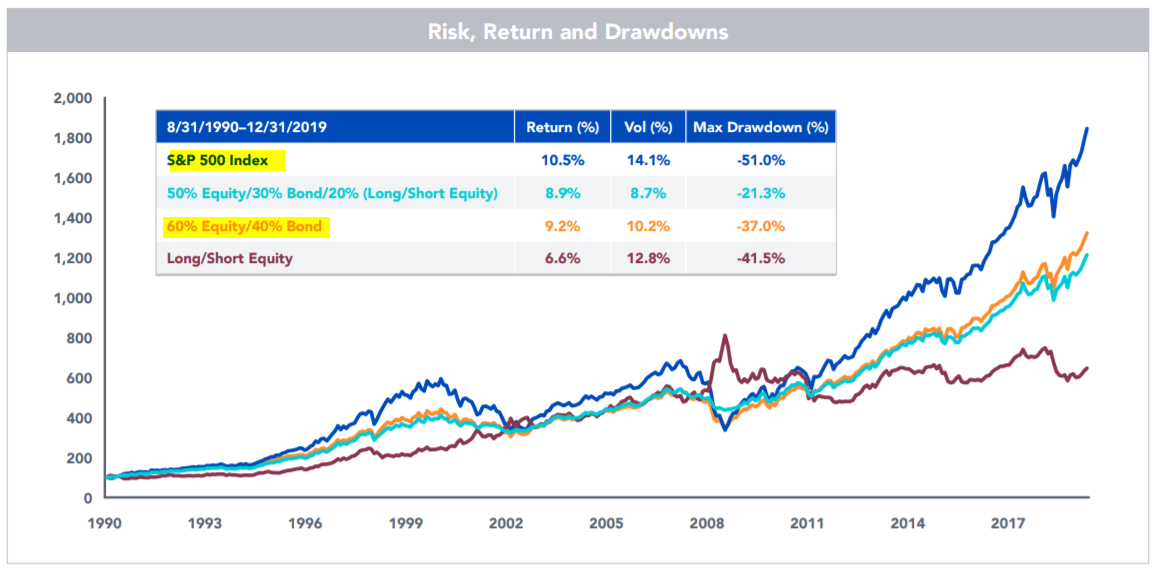

Overall risk-adjusted returns tend to be quite strong, as has been the case for most of the past two decades. The data I have on this is a bit old, but I’ll be discussing more recent events soon enough.

NTSX

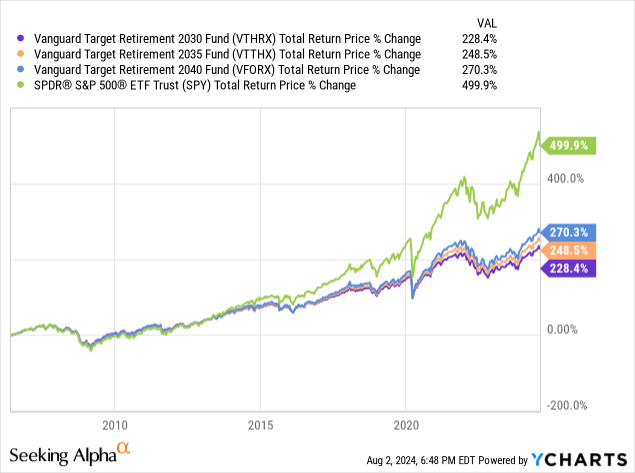

Although balanced funds have comparatively strong risk-adjusted returns, absolute returns are generally lower than those of equities. One can see that in the graph above, and when comparing the returns of Vanguard Target Retirement Funds, balanced funds targeted towards future retirees, with those of the S&P 500.

Data by YCharts

In light of the above, some investors have chosen to create leveraged balanced portfolios, with the aim of outperforming equities on both risk-adjusted and absolute returns.

NTSX itself is a 1.50x leveraged balanced fund, with a 90/60 equity/treasury exposure. In practice, this means that NTSX’s shareholders receive 90% the returns and losses of the equities market, 60% for treasuries. The fund accomplishes this by investing in the following three components:

- Equity Component: NTSX has $90 invested in large-cap equities for every $100 invested in the ETF. The fund experiences about 90% of the returns and losses of the S&P 500

- Treasuries Component: NTSX has $60 of treasury futures for every $100 invested in the ETF. The fund experiences about 60% of the returns and losses of medium-term treasuries

- Cash Component: NTSX’s treasury futures require that $10 for every $100 invested in the fund be kept in short-term collateral, which earns returns comparable to U.S. Treasury bills

NTSX’s strategy has straightforward implications for the fund’s performance.

In most cases, both equities and treasuries are up, leading to sizable gains for the fund. Leverage boosts these, leading to outperformance.

In some cases, both equities and treasuries are down, leading to significant losses. Leverage boosts these, leading to underperformance.

Overall returns are dependent on the relative magnitude / common of the scenarios above. Long-term, both equities and treasuries see gains, so the fund should outperform long-term. If periods of both equities and treasuries being down become more common, the fund could underperform long-term. Significant, long-lasting stress in both equity and treasury markets could lead to significant, long-lasting losses and underperformance too.

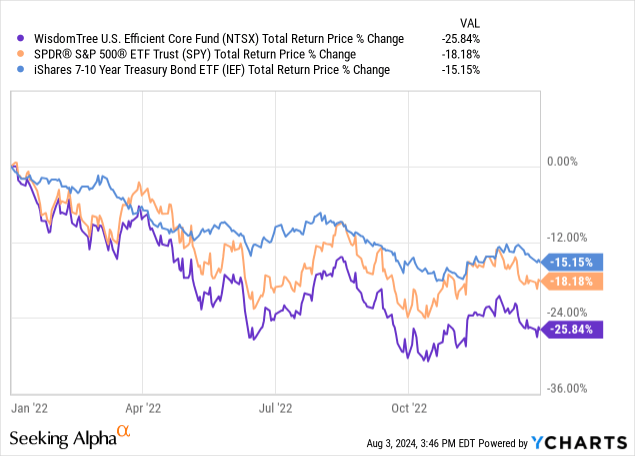

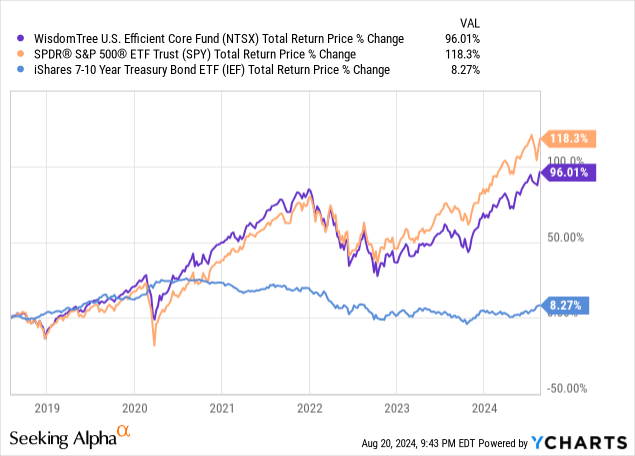

Since NTSX’s inception, we’ve gone through one period of both equity and treasury losses, the 2022 – 2023 inflationary spike. NTSX significantly underperformed during said time period, as expected.

Data by YCharts

The losses above completely wiped out prior outperformance and have been responsible for NTSX underperforming the S&P 500 since inception. Drawdowns have been higher too, see above.

On a slightly more positive note, these losses were not significant enough so as to become irrecoverable. This is sometimes the case for leveraged funds, so it is important to check / specify.

Although NTSX has underperformed since inception, I’m still broadly bullish for three reasons.

First, periods of both equity and treasury losses are uncommon. Inflation spikes have only occurred twice in the past fifty years: after the pandemic, and in the 70s. Losses have occurred a few other times too, but these have generally been small and short-lived.

Second, selling NTSX when there is risk of inflation seems easily doable. I said as much in early 2022, just before the Fed started to hike. Timing the market is never easy, but avoiding investments in periods of heightened macro stress or risk is much easier.

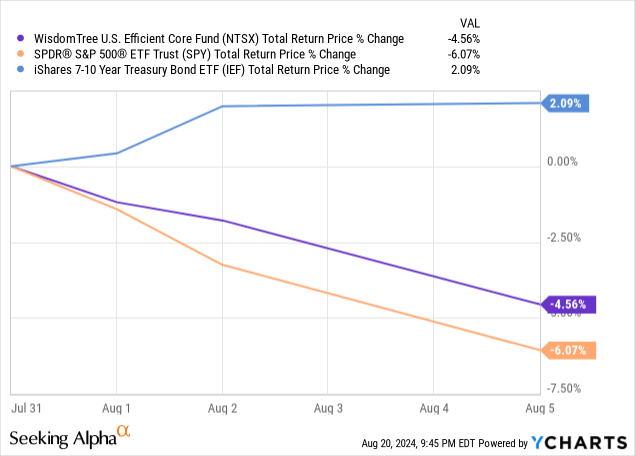

Third, correlations between equities and treasuries have turned negative once more, as inflation seems to have finally normalized. One can see this in the mini drawdown earlier in August: equities declined due to worsening economic conditions, treasuries rallied on expectations of future rate cuts, NTSX saw comparatively small losses.

In my opinion, conditions are such that correlations should remain positive / both equities and treasuries should not see losses. We either get a recession, and hence higher treasury prices with equity losses, or a soft landing, with further equity gains and treasury stability. Inflation could always spike again, but this does not seem likely.

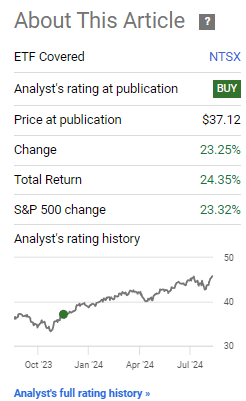

As such, I’m bullish on NTSX, and believe it will outperform the S&P 500 moving forward. As an aside, the fund has slightly outperformed since my last article, in late 2023:

NTSX Previous Article

NTSX’s underperformance was entirely due to the past inflationary spike. Avoid that, and the fund outperforms, as it has since my last article.

Conclusion

NTSX’s leveraged and balanced equity and treasury holdings should outperform the S&P 500 long term, and at somewhat lower risk and volatility. Although this has not been the case since inception, I’m confident it will be the case moving forward. As such, I rate the fund a buy.

Read the full article here