Fellow Shareholders:

We have spoken enough of just how difficult this environment has been for small cap stocks relative to large caps, especially the largest of the large. The bear market for our asset class has lasted far longer and driven valuations down far further than I ever would have thought possible. We think this phenomenon may finally be reversing following the Fed move to cut rates starting in mid-September and the removal of uncertainty around the outcome of the US election. One near-term indicator for this transition is that since these events, the Russell Microcap Index has doubled the performance of the SPX 500 (SP500, SPX). We continue to believe there is significant opportunity going forward for small capitalization stocks, particularly given the backdrop of their historically low valuations in general and relative to large capitalization stocks. I have seen this play out time and time again during my 35+ years of experience through these types of investment cycles. While it is always possible this time is different, recent market trends have similar characteristics to those that, upon reflection, turn out to be market bottoms. Excessive pessimism is usually followed by periods of strong growth.

For this quarter’s letter, I could go on and on about the market, but I have discussed these points ad nauseum in prior letters and white papers. I’ve also gone through our constructive activism and how the catalysts we identified, we believe, could lead to material appreciation in our portfolio holdings in those prior letters and papers. Rather than go through each of these holdings in this letter, I’d rather spend the time being retrospective about what we took over and what we did to remake the business, and, with the lens of an activist, be introspective on what questions should we be asking and answering now, to put 180 Degree Capital (NASDAQ:TURN) in the best position for value creation for its shareholders.

Given it has been over 7 years since Daniel and I took over the predecessor of 180 Degree Capital, which was known as Harris & Harris Group, some of our shareholders may not be fully aware of the history that led to us running the firm. After I left BlackRock (BLK) in 2012, I decided to start a friends-and-family fund focused on small cap activism using my value-based investing approach. In 2016, I was nominated by an activist to Harris & Harris’ Board. The existing Board welcomed my addition without the need for a proxy fight because they understood the company was in dire need of a new investment focus and approach :

- Due to a number of secular changes, the business model of venture capital investing coupled with longer periods to exits became a significant mismatch with the expectations of public market investors who demand more frequent returns and generation of liquidity.

- The elongated holding time of investments required the investment of substantially more capital in such investments than historically was required for such private companies.

- Venture capital investments are non-income producing and getting access to such invested capital is difficult to impossible at reasonable valuations outside of a whole-company solution such as an initial public offering or sale.

- Without the ability to predictably generate returns on investment and the inability to raise additional capital due to the entity trading below NAV, Harris & Harris Group ran the risk of insolvency due to ongoing operating expenses.

I will be forever proud that Daniel and I, along with the Board, embraced change when we did, as the alternative for our shareholders would likely have ended poorly. The first 5 years of 180 Degree Capital were sensational for all our shareholders. The last 3 years have been more than frustrating. So, with 180 Degree Capital’s stock having retraced our gains, the current price sits at a place where I ask, as an activist, is there something for us to do differently than we are doing currently. We like to “walk the walk,” so let’s walk through some of the questions we typically ask when assessing potential activism within our portfolio holdings or companies we are looking at, and then provide our answers to these questions with regard to 180 Degree Capital:

Does the company have the right strategy?

Prior to the inception of 180 Degree Capital and its investment strategy, the answer was no. Today, I firmly believe the answer is yes. As I said above, I’ve been a public market investor for 35 years. I know that there are periods of performance where you look like a genius, and there are periods where you where you look (and feel) the complete opposite. I have gone through both, and that’s the business. If I had a dollar every time someone tried to convince me to change my process at the bottom, I’d be a billionaire. I never have succumbed to such advice, and I never will. That said, I learn from mistakes and endeavor to not repeat them, I use additional information to try and make better decisions, and I adjust my thought processes to reflect the reality of today and any trends that may impact tomorrow.

Let’s just look at the facts. During the first five years of 180 Degree Capital, we crushed it. The last 3 we haven’t. Unfortunately, it happens. We’re focused on taking steps that will lead to a return to positive performance. We continue to believe that the universe of small capitalization public companies is the right place to be investing for 180 Degree Capital. These companies are often in desperate need of help from constructive activists, such as us, to help unlock value through the types of things we have done historically. In particular, we believe this next upcoming investment cycle will present the need for creative capital structure solutions to address upcoming debt maturities, remove preferred stock overhangs, provide acquisition financing, and expand access to growth capital. Ideally these solutions can come from partners that have strong relationships with management teams, and we are positioning 180 Degree Capital to be this partner.

The bottom line is that we need our holdings to do well, our activism to result in good outcomes, and the public markets to reward such results. While these outcomes can take time, and the path is rarely along a straight line, these timeframes are much more aligned with the expectations of public market investors than those of investing in early-stage, private companies.

Is there going-out-of business risk if the strategy takes too long to implement?

Harris & Harris Group was headed toward insolvency if it kept operating under the same strategy. With the benefit of hindsight, we are now even more certain of this outcome given the poor returns from the legacy private portfolio. This risk does not exist for 180 Degree Capital because we successfully transitioned its balance sheet to cash and publicly traded securities. This composition of our balance sheet along with permanent capital enables us to be focused on building value through our investments and activism rather than worrying about whether the entity survive through episodic and cyclical downturns as we have experienced during the past three years.

Does the company have the right operating model and expense structure?

When Daniel and I took over 180 Degree Capital, we reduced our operating expenses overnight from $6.5 million to approximately $3 million. We moved from 8,000 sq. ft. of space in Midtown Manhattan that previously cost over $350,000 per year to a small office space that costs less than $40,000 per year. We went from two administrative assistants to zero. We use freeconferencecall.com to host our shareholder calls at zero cost. We changed the regulatory structure of the firm from a business development company to a closed-end management investment company because it allowed us to substantially reduce our auditing and compliance-related costs. We did this, even though doing so disadvantaged management by eliminating the ability to issue stock as compensation to management and the Board.

We look for and take advantage of opportunities to reduce costs wherever we can. The costs we do have are those required for us to operate as a public company and for the compensation of our three full-time and one part-time employees. We have not paid performance bonuses to the management team for the prior two years, as our results did not meet our expectations of value creation for stockholders.

Are all interests aligned with shareholders, and have management and the Board demonstrated this alignment through open-market purchases?

The interests of the management and the Board are very much aligned with our shareholders, particularly since we collectively own 12.7% of 180 Degree Capital, with Daniel and I owning 2.5% and 7.9%, respectively of this amount. I am the largest stockholder of 180 Degree Capital. Daniel is the fifth largest. It is important to remember that neither management nor our Board receive compensation in stock as mentioned above. Substantially all of our ownership was purchased in open-market transactions at significantly higher prices than where 180 Degree Capital’s stock trades at today. If that is not being fully aligned with stockholders, I am not sure what is. We have significant “skin in the game” and have endured the same pain as all of our shareholders due to pressure on our stock price.

Additionally, since the inception of 180 Degree Capital, members of management and/or our Board have purchased common stock in the open market in every quarter except one, the prior quarter. You might ask, why were there no purchases during the prior quarter? As is the same for all public companies, it could be one of two reasons: 1) neither management or the Board desired to purchase additional stock, or 2) management and the Board were not permitted to purchase stock because of regulatory restrictions, such as possessing material non-public information outside of blackout periods. I’ll leave it to you to determine which you think is the reason.

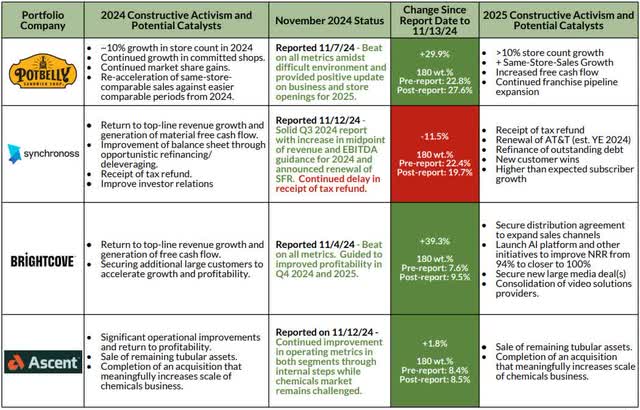

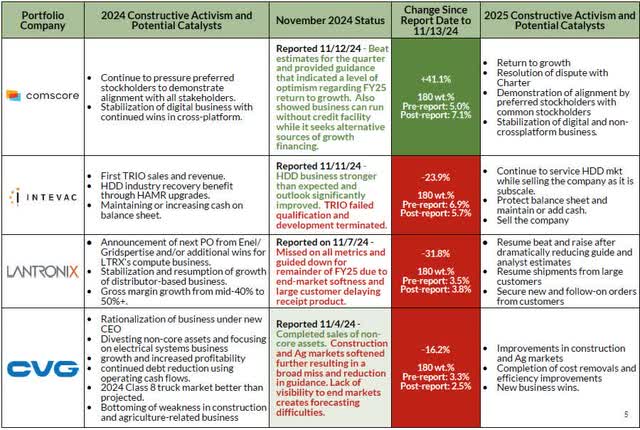

At the end of the day, 180 Degree Capital’s management and Board are focused on the careful assessment of what will give the 180 Degree Capital the best chance to succeed for its shareholders going forward. We are doing everything we expect our investee companies to be doing. We “walk the walk,” and follow proper procedures and corporate governance along the way. We do not have our head in the sand thinking that growth and value creation will solely come from returns on our existing investments. We are always evaluating strategic options to increase our assets and capabilities to take advantage of opportunities to build value and the overall scale of our business. We appreciate that our largest and longest shareholders have expressed their support for these efforts and understanding that this progress does not happen overnight. We look forward to discussing these efforts with all of our shareholders as is appropriate and permitted. In the meantime, we continue to execute on our investment strategy. The slides below provide an update on our holdings and what we are doing to constructively advocate for value creation at those companies and, as a result, for 180 Degree Capital shareholders that we will discuss in additional detail on our upcoming shareholder call:

As always, thank you for your support.

Best Regards,

Kevin M. Rendino | Chief Executive Officer

|

Forward-Looking Statements and Disclaimers This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company’s current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company’s securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company’s business and other significant factors that could affect the Company’s actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here