Introduction

I’m a picky investor. Currently, I own just 22 individual dividend (growth) stocks. I also have a watchlist of 29 stocks I would love to own at some point.

When it comes to high-yield investing, I’m even more picky, as some high-yield stocks tend to be value traps. More often than not, stocks offering elevated income have subdued growth rates.

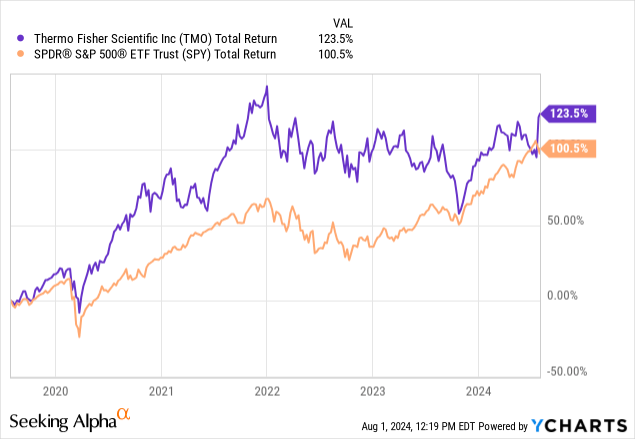

For example, a company like Thermo Fisher Scientific (TMO), a supplier of high-tech biotech equipment, has a five-year dividend CAGR of 15.5%. However, its dividend yield is just 0.3%. That’s because its stock price has offset dividend growth, returning 124% over the past five years.

There are many more examples like Thermo Fisher of companies where the market won’t let its yield rise, as growth is simply too rewarding to apply a low free cash flow multiple. After all, to some extent, a dividend yield is part of a company’s valuation.

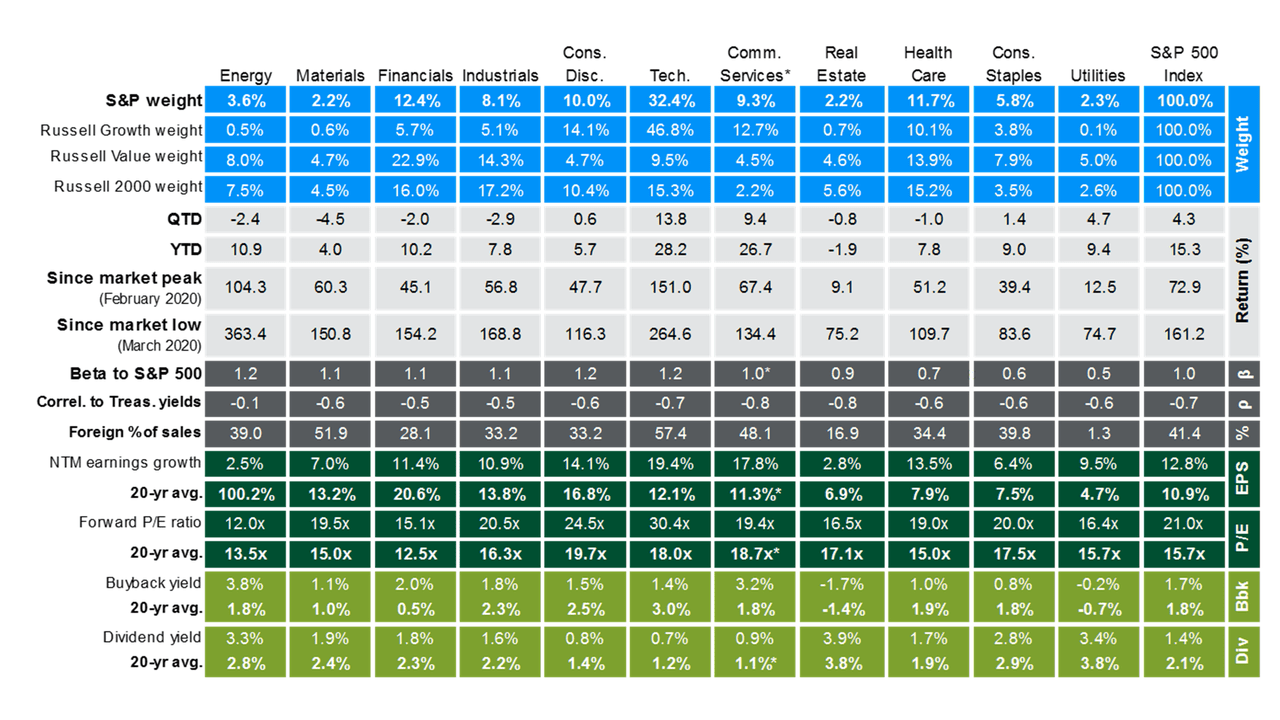

Using the data below (the bottom rows), we see the highest yields can be found in the energy, real estate, consumer staples, and utility sectors. While some of these sectors are home to fast-growing companies, they are not known for offering elevated growth.

JPMorgan

All these sectors have one thing in common: they are full of companies with mature business models that can afford to distribute a large part of their free cash flow/earnings to shareholders.

That’s also why they are not necessarily the first choice of investors seeking growth.

As I expect (God willing) to have many more decades left to grow my wealth, I maintain a balanced approach, buying low-yield dividend stocks with aggressive growth, stocks with a decent yield and decent growth, and high-yield stocks capable of decent growth. I usually avoid companies in low-moat areas like finance.

This brings me to Antero Midstream (NYSE:AM). I have praised this stock a lot since the end of the pandemic and finally pulled the trigger on it, making it a core position at the start of this year.

In fact, it’s my sixth-largest investment, making it my largest high-yield investment.

My most recent article on the stock was written on April 28, when I wrote the following:

As such, the company has room to run to at least $19, which is roughly 30% above the current price.

While it may take time for AM to get there, it adds to its appeal, as AM is much more than just a high-yielding energy play.

It has become my favorite high-yield stock and a company I will continue to buy aggressively on stock price pullbacks.

Since then, shares have been flat, lagging the S&P 500 by almost 7%. The good news is that while its stock price may be falling a bit, its just-released earnings confirm the long-term thesis and a path to much higher shareholder distributions of this stock, which already yields 6.3%.

So, as we have a lot to discuss, let’s dive into the details!

The Antero Benefit

Antero Midstream is, as its name already suggests, a midstream company. This means it does not produce oil and gas. It owns critical infrastructure that allows others to produce gas.

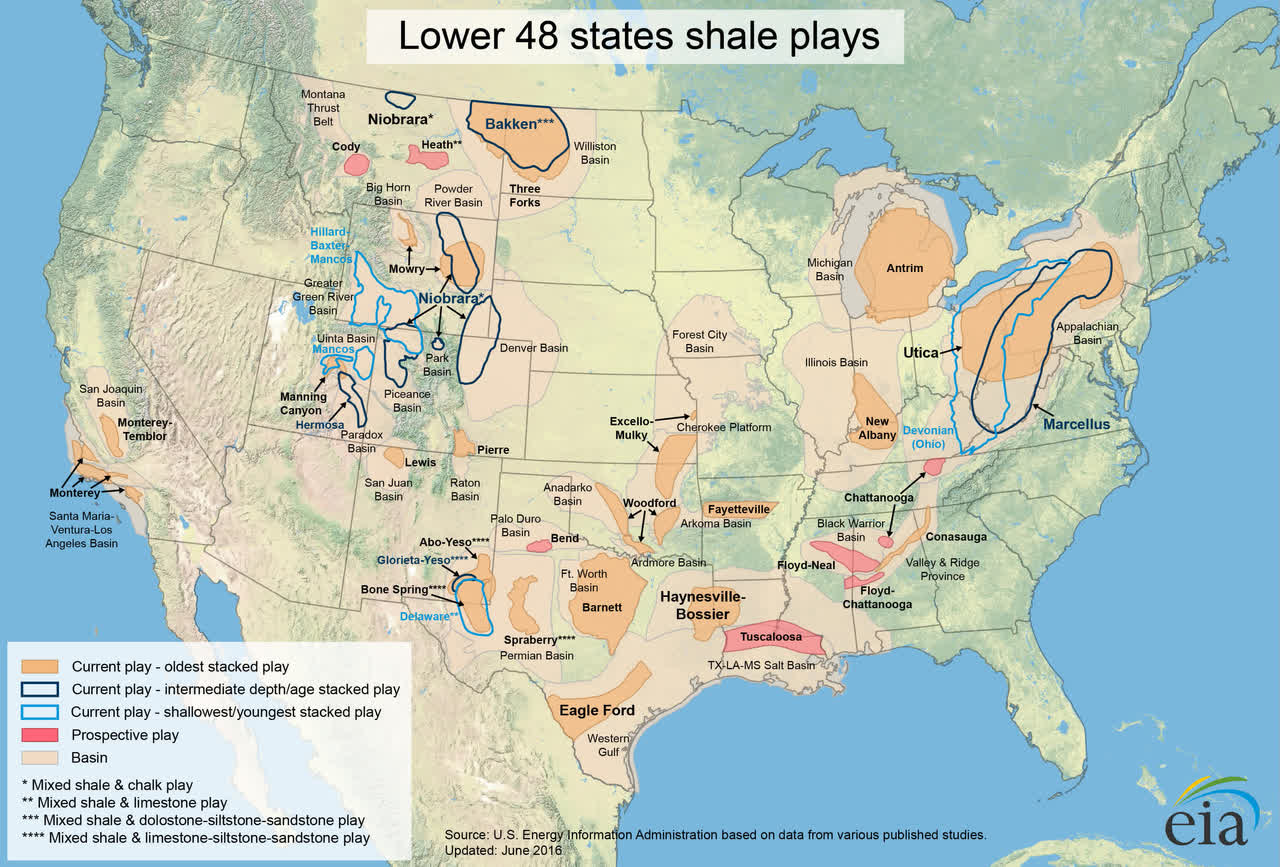

In this case, its partner is Antero Resources (AR), which also owns close to a third of its outstanding common stock. Antero Resources is one of North America’s largest natural gas producers, with a major footprint in the Marcellus Basin in Appalachia, the “place to be” for low-cost natural gas production.

Energy Information Administration

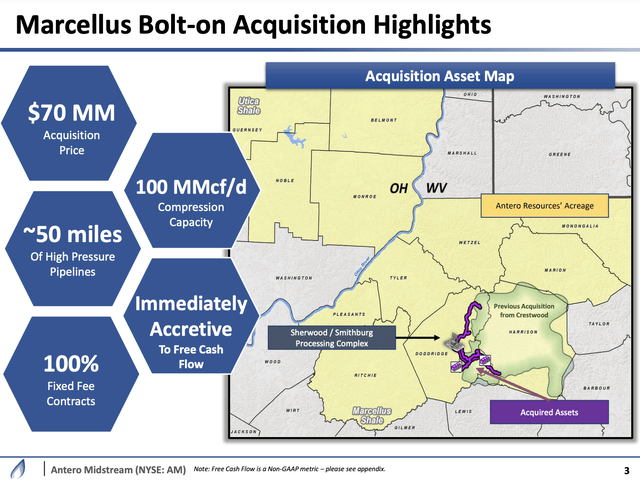

This year, Antero Midstream has finished a $70 million “bolt-on” acquisition from Summit Midstream, which includes two compressor stations and roughly 50 miles of high-pressure pipelines.

According to the company, these assets are strategically located in the Marcellus shale and were seamlessly integrated into its existing infrastructure.

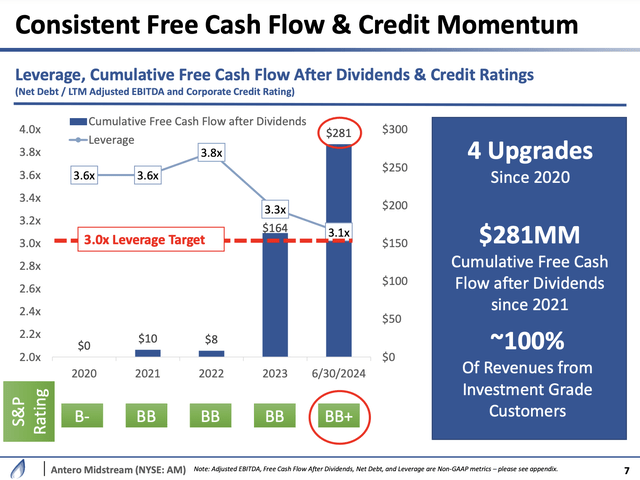

This deal is key, as it supports Antero Resources’ production without delaying Antero Midstream’s plans to reduce its leverage to less than 3.0x EBITDA.

Antero Midstream

Going into this year, it owned 400 miles of low-pressure pipelines, 230 miles of high-pressure pipelines, and 4.5 billion cubic feet of daily compression capacity. It also has 380 miles of water pipelines.

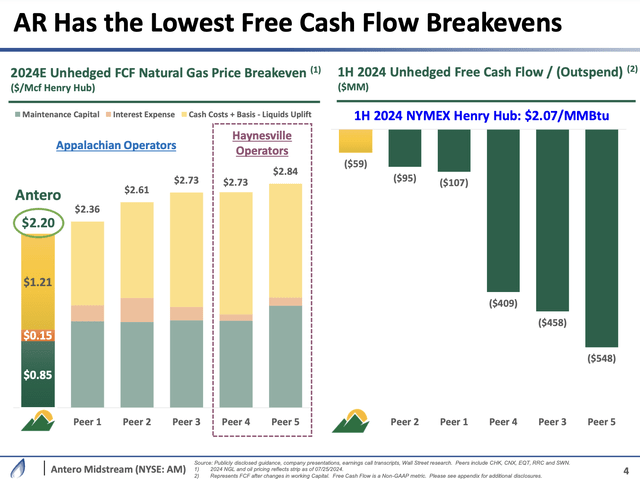

With that said, what sets Antero Resources apart is its super low breakeven price of $2.20 per Mcf (see the overview below), allowing it to produce at prices so low that less efficient producers are forced to cut output.

It also has substantial exposure to higher-margin products like NGL (natural gas liquids).

According to Antero Midstream, AR’s exposure to international markets and widening ARPS have led to favorable pricing for C3+ NGLs, providing a $1.10 per Mcfe benefit in price realizations during the first half of this year.

Antero Midstream

This strong pricing environment has allowed AR to maintain a peer-leading unhedged free cash flow profile.

To be more specific, even with NYMEX Henry Hun prices averaging just $2.07 in the first half of 2024, Antero Resources’ unhedged outspending (negative free cash flow) was just $59 million.

Because AR is so efficient, AM has a subdued risk of seeing lower throughput and processing volumes when prices are down. However, it’s not immune, which is why the stock price has come down a bit.

Deep Value Despite Temporary Headwinds

Right now, natural gas prices are a hot mess.

TradingView (NYMEX Henry Hub)

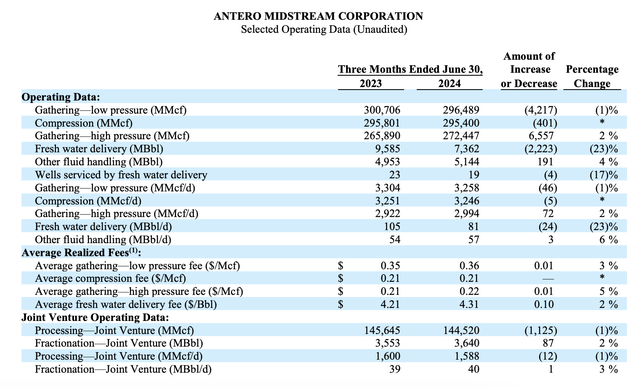

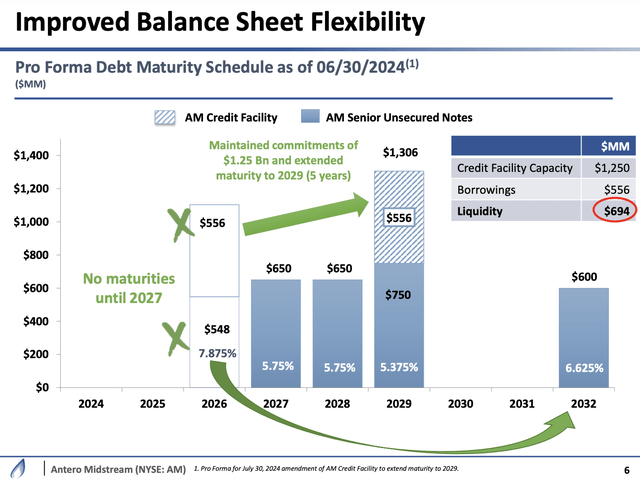

Despite challenging natural gas prices, Antero Midstream reported $255 million in 2Q24 adjusted EBITDA, 5% more compared to 2Q23.

According to the company, this was achieved despite a conservative operational setup, with Antero Resources operating only two rigs and one completion crew – due to subdued natural gas prices.

This is also visible in the operating numbers below, which show what happens when production activity slows down. Especially, water volumes were down due to one less completion crew and the timing of a 7-well pad that began service at the end of June.

Antero Midstream

The good news is that the company also generated significant free cash flow after dividends of $43 million, a 41% increase compared to the second quarter of last year.

Antero Midstream

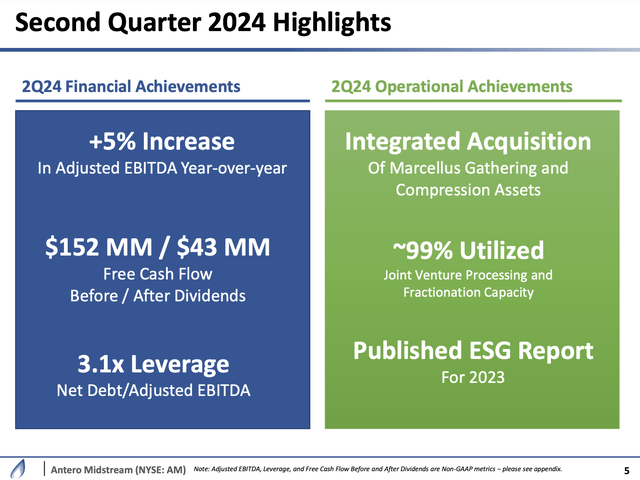

With regard to balance sheet health, leverage remained at 3.1x (EBITDA). The aforementioned $70 million (cash-funded) acquisition did not increase leverage as it was accretive to free cash flow right from the start.

In general, the company’s balance sheet remains strong, supported by successful refinancing activities, including a $600 million issuance of senior notes due in 2032, which were upsized due to high demand.

According to the company, these actions lowered future interest expenses and improved liquidity. It also has no maturing debt until 2027.

Antero Midstream

As a result, the company has seen steady credit rating upgrades, with S&P Global upgrading the corporate rating to BB+ in May of this year. As we can see below, this is the fourth upgrade since the end of 2020.

Although a BB+ rating is a “junk” rating, the balance sheet is not risky, which is why AM is one of the few exceptions I made when it comes to buying non-investment grade ratings.

Antero Midstream

Given the big picture, the company believes if it continues to strengthen its balance sheet and maintain financial flexibility, it is well-positioned to capitalize on future growth opportunities and potentially increase capital returns to shareholders.

This brings me to the next part of this article.

Shareholder Returns & Valuation

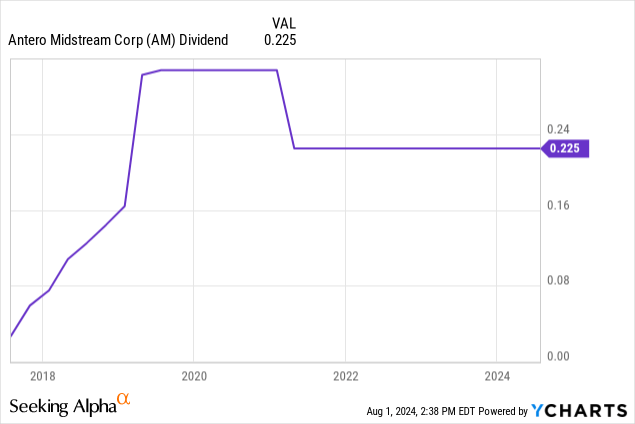

The Antero Midstream dividend is one of my favorite things about this company. Currently, the company pays $0.90 per year in four quarterly payments.

This translates to a yield of 6.3%.

As we can see below, the dividend has been unchanged since 2021.

The good news is that this dividend is protected by a healthy balance sheet and plenty of free cash flow. After all, post-dividend free cash flow was $43 million.

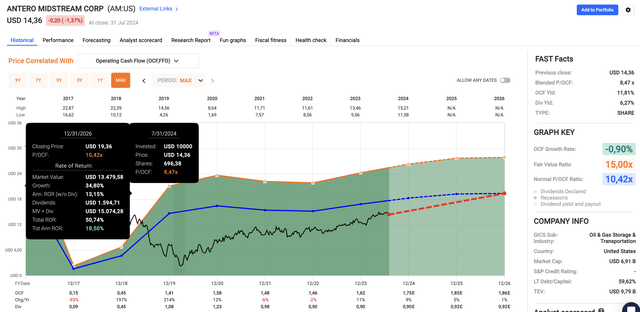

Moreover, this year, analysts expect the company to generate $702 million in free cash flow, potentially followed by a gradual surge to $710 million by 2026. This indicates a 2024E free cash flow yield of 11% using the company’s current $6.7 billion market cap.

This implies a 57% dividend payout ratio, which is extremely low for a midstream company.

As the company is expected to reach its leverage target in 4Q24 or 1Q25, it is very close to accelerating shareholder distributions.

During its earnings call, the company explained its plans to initiate a buyback program in the second half of the year, supported by a $500 million authorization.

This is due to the attractiveness of its current stock valuations and will be accelerated once net leverage has been lowered to 2.9x or 2.8x EBITDA.

As the company has an implied free cash flow yield of 11%, it has a lot of room for aggressive buybacks and dividend growth in the years ahead, which is one of the reasons why I’m so bullish on the stock.

In general, I believe the company is doing a stellar job using bolt-on M&A projects to expand its footprint without the need for risky expansions that pressure free cash flow and balance sheet health.

I also agree with its plans to emphasize buybacks. AM equity is very cheap, making buybacks a great method of distributing cash.

Using the FactSet data in the chart below, the company is trading at a P/OCF (operating cash flow) ratio of 8.5x. Its normalized P/OCF ratio is 10.4x. When adding expectations of 16% cumulative expected per-share OCF growth through 2026 (excluding buybacks), we get a fair stock price of $19.40, 35% above the current price.

FAST Graphs

As such, I will continue to add to my AM position, as it is truly my favorite high-yield stock and a company that has brought a lot of value to most income-focused family portfolios that I advise.

Takeaway

As a picky investor, I focus on balancing high-yield stocks with potential for growth.

Antero Midstream has become my largest high-yield holding, combining a juicy 6.3% dividend yield with a fantastic business model.

Despite recent market volatility and low natural gas prices, AM’s strategic acquisitions and efficient operations have supported its financial health.

Meanwhile, the company’s commitment to reducing leverage and its attractive valuation make it a standout in the midstream sector.

As AM approaches its leverage target, I expect to see accelerating shareholder returns through buybacks and dividend growth.

This is why AM remains a top pick in my portfolio and a fantastic place to be for everyone seeking high-quality income.

Pros & Cons

Pros:

- Elevated Dividend Yield: AM offers a juicy 6.3% dividend yield, supported by a healthy balance sheet and solid free cash flow.

- Strategic Growth: The company’s recent acquisitions and infrastructure investments enhance its position in the low-cost Marcellus Basin, boosting long-term growth potential.

- Resilient Operations: Even with challenging natural gas prices, AM has maintained steady EBITDA growth and a low payout ratio, providing dividend safety.

- Upcoming Buybacks: With leverage reduction on track, AM plans to accelerate buybacks, potentially boosting the per-share value of its business for many years to come.

Cons:

- Exposure to Natural Gas Prices: Although AM has a fee-based business model, sub-$2 natural gas prices on a prolonged basis are likely to pressure growth.

- Dependence on Antero Resources: Technically speaking, AM’s close ties with Antero Resources pose a concentration risk. However, so far, this is a benefit, as it helps AM to plan operations. It creates visibility and stability, as both AM and AR are dependent on each other – in a good way.

- Non-Investment Grade Rating: Despite recent improvements, AM’s BB+ rating is not an investment-grade rating. The good news is that further credit rating upgrades are likely, as its balance sheet is healthy. Investors are NOT exposed to elevated financial risk.

Read the full article here