Just as it marks the transition from summer to fall, September has often been a transitional month for monetary policy and financial markets.

In September 1998, the Federal Reserve initiated an interest-rate-cutting cycle and a bailout of Long-Term Capital Management in the wake of financial crises in Asia and Russia. In September 2007, the Fed began cutting rates at the dawn of what would become the global financial crisis.

A year later, Lehman Brothers’ bankruptcy on 15 September 2008 marked a peak in that crisis. The authors of this column witnessed the aftereffects of Lehman’s collapse firsthand in midtown Manhattan and London’s Canary Wharf, respectively.

Many investors can recall exactly where they were at such significant moments. The Fed’s policy meeting on 18 September this year could be no less consequential.

That’s when the Fed is set to cut rates after the sharpest hiking cycle in decades to tame the post-pandemic inflation spike. This time, instead of fighting an incipient crisis, the easing may signal a return to normalcy as inflation appears to stabilize.

Because Fed easing cycles are never alike, we’ll examine the current situation, some patterns in past cycles, and what this could mean for investors.

It’s time to cut

For over a year, the Fed has maintained its policy rate at 5.25%–5.5%, the highest since 2001 and up from near zero in early 2022. Despite these restrictive rates, the U.S. economy has remained resilient, while equity markets have hit new highs. Headline U.S. inflation, which peaked at about 9% in 2022, has receded to “two-point-something” percent levels, within reach of the Fed’s 2% target.

With inflation on track to return sustainably to target, the focus shifts to employment – the other half of the Fed’s dual mandate – and the need for precautionary rate cuts to address a cooling labor market. While inflation risks have diminished, labor market risks are rising, as seen in recent employment data.

When these risks are balanced, policy rates should be at neutral rather than restrictive levels. The Fed’s latest projections from June estimate the neutral rate to be more than two percentage points below the current policy rate. At this point, we believe there’s no reason to delay normalizing rates.

We continue to expect the Fed to cut three times this year by a total of 75 basis points in our baseline view. Similar to how the Fed began its tightening cycle, we believe it will likely start easing slowly and maintain optionality to increase the pace of rate cuts depending on incoming economic data.

Rate cuts and asset performance

Historically, market performance has varied depending on whether rate cuts are initiated amid material economic weakness (a hard landing scenario) or more moderate conditions (a soft landing). Some examples:

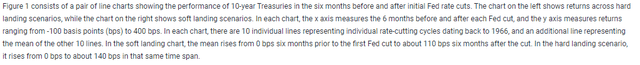

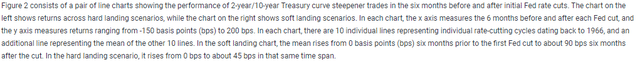

Intermediate- and longer-term bonds have performed well, especially in hard landings. Cash rates are likely to come down as the Fed lowers its short-term policy rate. Bonds of intermediate and longer duration can benefit from price appreciation and historically have tended to perform well during cutting cycles (see Figure 1), particularly if the economy weakens.

Figure 1: 10-year Treasuries have tended to perform well after Fed rate cutting cycles begin

Source: PIMCO calculations as of 21 August 2024. Returns to 10-year U.S. Treasury correspond to excess returns over cash to the Bloomberg U.S. Treasury 7–10 Year Index, per year of modified duration, rebalanced monthly. Historical returns before inception of the Bloomberg indices are estimated from par rates provided by Gurkaynak, Sack, and Wright (2006; Board of Governors of the Federal Reserve) and from the “H15” series of constant-maturity yields from the Federal Reserve. For illustrative purposes only. Figure is not indicative of the past or future results of any PIMCO product or strategy.

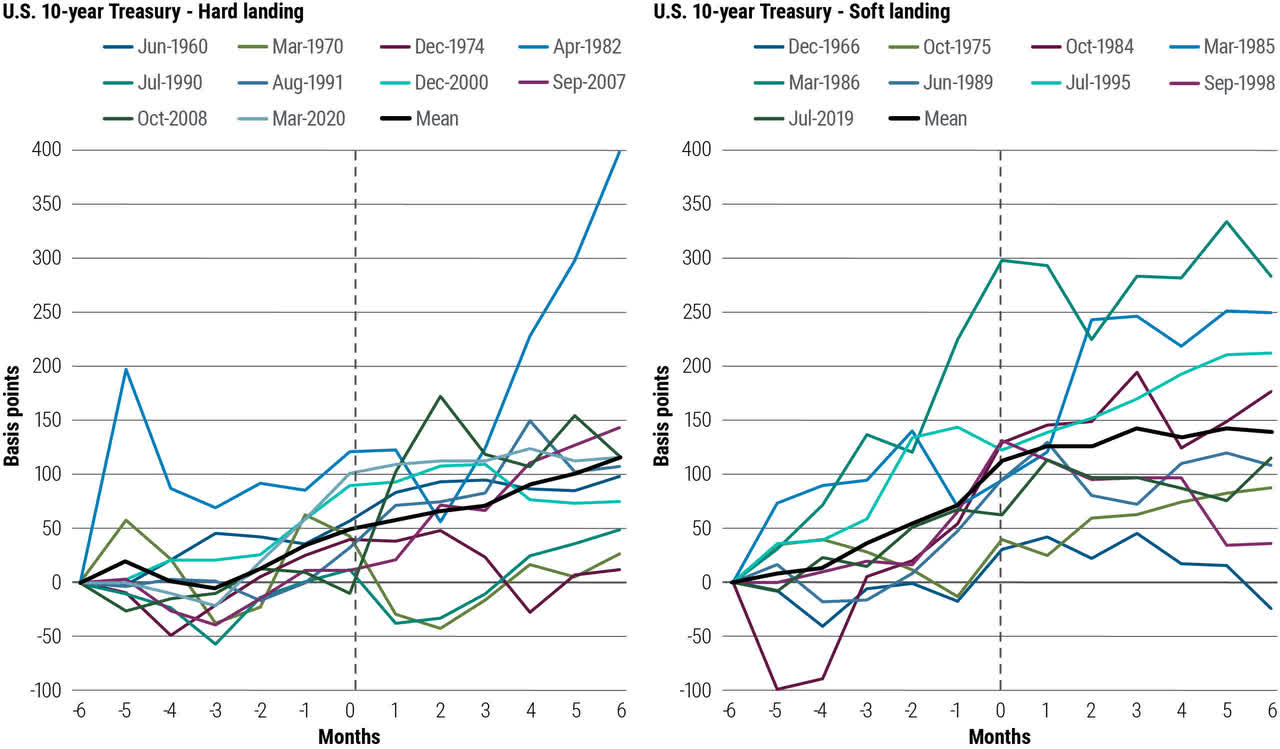

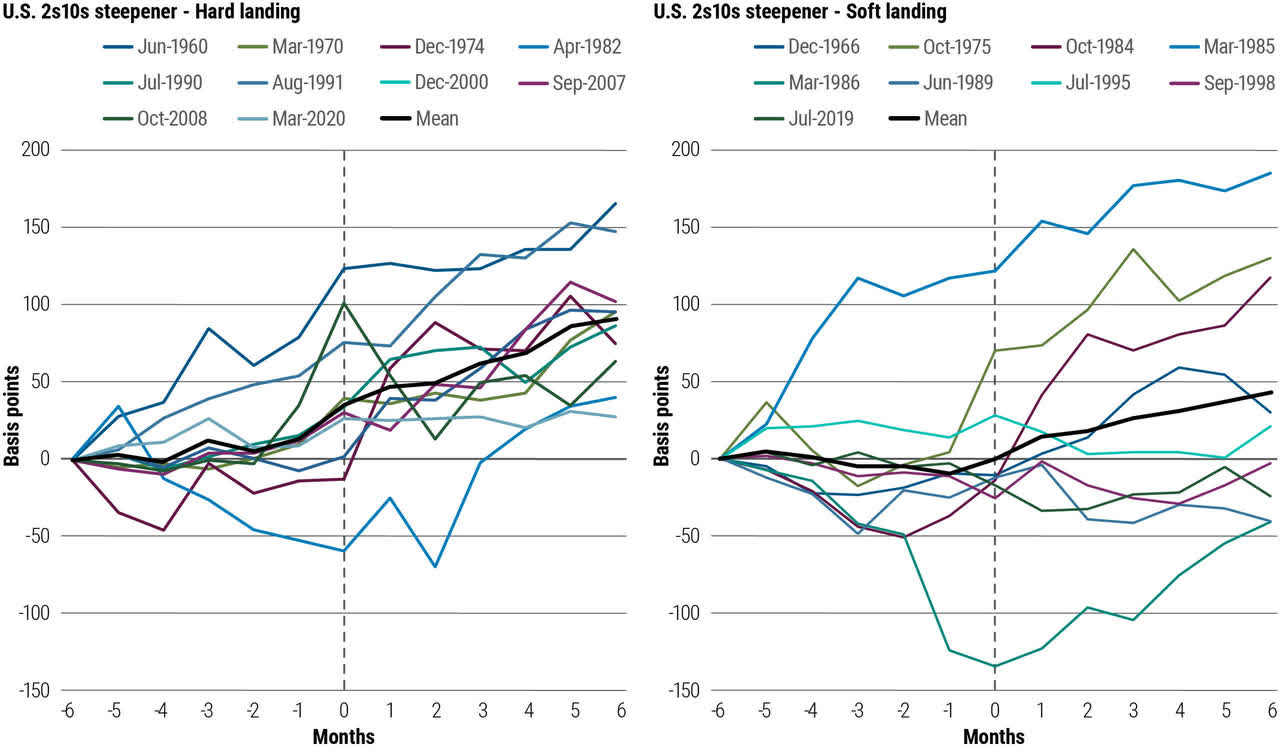

Curve-steepener trades have performed well, particularly in hard landings. Positioning for a normalization of the U.S. yield curve, which has recently re-steepened after its longest sustained inversion on record, could benefit most if the Fed cuts short-term rates significantly to combat economic weakness (see Figure 2).

Figure 2: Yield curves have tended to steepen after the Fed starts cutting rates

Source: PIMCO calculations as of 21 August 2024. Returns to U.S. Treasury 2s10s steepener correspond to excess returns to 1-year duration in the Bloomberg U.S. Treasury 1–3 Year Index, versus excess returns to short 1-year duration in the Bloomberg U.S. Treasury 7–10 Year Index, rebalanced monthly. Historical returns before inception of the Bloomberg indices are estimated from par rates provided by Gurkaynak, Sack, and Wright (2006; Board of Governors of the Federal Reserve) and from the “H15” series of constant-maturity yields from the Federal Reserve. For illustrative purposes only. Figure is not indicative of the past or future results of any PIMCO product or strategy.

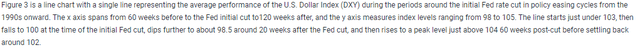

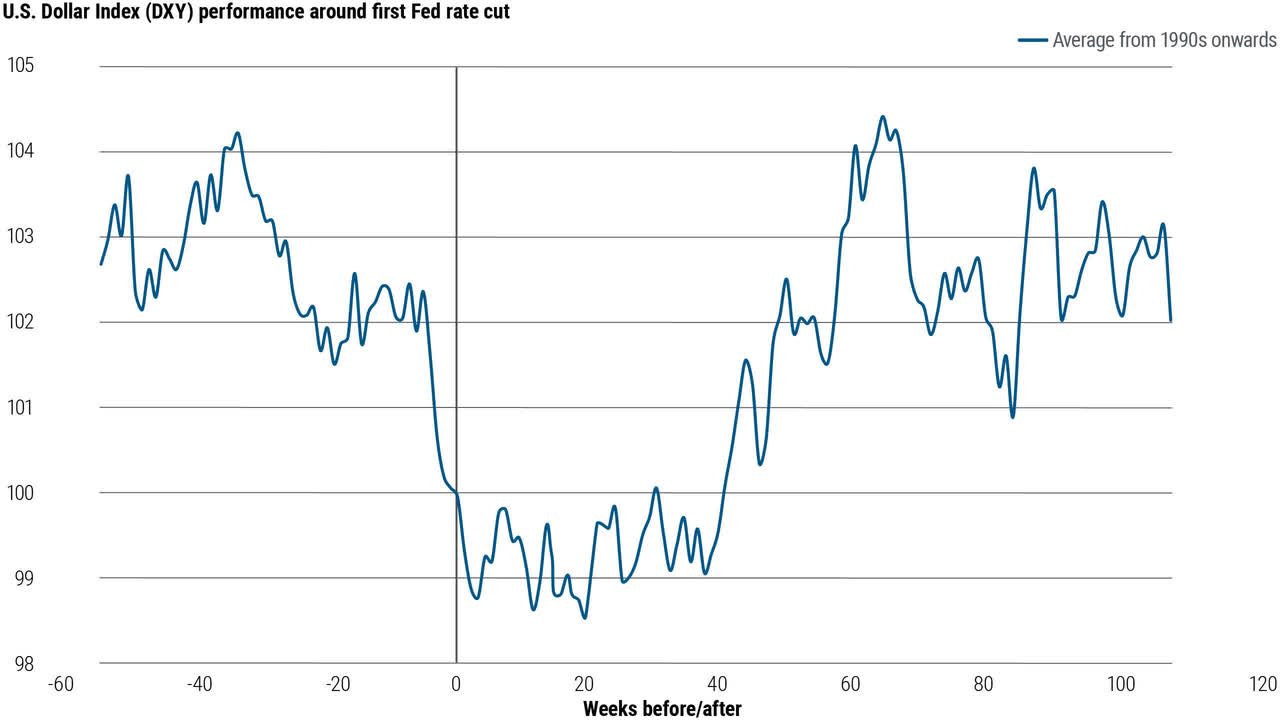

The dollar has tended to decline, at least temporarily. In past easing cycles, comprising both hard and soft landings, the U.S. dollar on average has tended to fall but then recover in the months following initial cuts (see Figure 3). We see the possibility of the dollar losing its status as a high-yielding currency as policy normalizes, with potential for moderate dollar depreciation.

Figure 3: The U.S. dollar has typically declined but then rebounded around initial Fed rate cuts

Source: Bloomberg, PIMCO calculations, as of 2021. For illustrative purposes only. Figure is not indicative of the past or future results of any PIMCO product or strategy. U.S. Dollar Index (DXY).

Prepare for landing

A hard landing is typically preceded by increasing unemployment, larger declines in manufacturing and services, negative equity returns, and tight or tightening financial conditions. In contrast, a soft landing is often preceded by little change in unemployment, positive equity returns, and loose or loosening financial conditions.

The current economic environment suggests a soft landing. Equity returns have been positive and financial conditions appear to be loosening. Unemployment remains low compared with previous cutting cycles despite modest softening

Markets are currently pricing the terminal Fed policy rate at about 3%–3.25%. That’s consistent with a soft landing and seems to assign little probability to a harder landing. We’ll also learn more about the Fed’s expectations for U.S. growth when it releases new economic projections at the September meeting.

Bonds can benefit from soft landings while offering low-cost hedging potential against hard landing scenarios. Bonds’ traditional hedging and diversification properties were most recently on display in early August and again in early September, when fixed income rallied during periods of stock market volatility.

Investors may look back at September 2024 as an opportune time to add fixed income exposure to portfolios, for the diversification benefits as well as the return potential. While yields have declined from peak levels, we believe they remain attractive in both nominal and inflation-adjusted terms – and that the bond rally has more room to run as the Fed starts cutting rates.

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Management risk is the risk that the investment techniques and risk analyses applied by an investment manager will not produce the desired results, and that certain policies or developments may affect the investment techniques available to the manager in connection with managing the strategy. Diversification does not ensure against loss.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

CMR2024-0904-3836206

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here