Equity LifeStyle Properties, Inc. (NYSE:ELS), founded in 1969, incorporated in 1992, and headquartered in Chicago, IL, primarily owns and manages manufactured home (MH) and recreational vehicle (RV) communities.

The position of this REIT seems to be very attractive and the niche market in which it operates beckons me to be exposed to it. Equity Lifestyle also has enjoyed tremendous growth throughout the years, with general rent growth fueling the most recent results. Despite its well-diversified portfolio, performance, and very strong liquidity, I think that the best course of action for potential shareholders is to add ELS to a watchlist and wait for a better price level because the current one creates a significant risk going forward.

Portfolio and Outlook

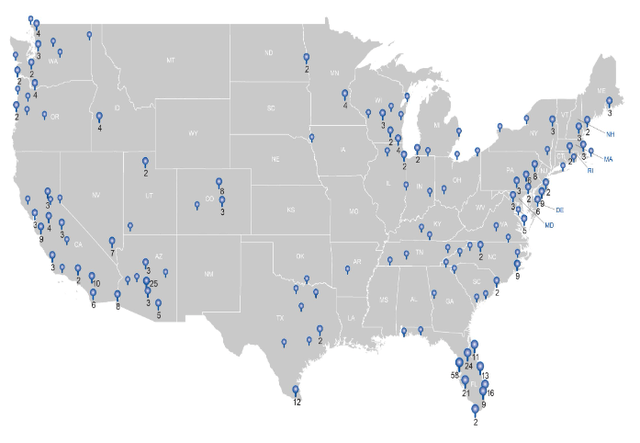

The REIT’s portfolio consists of 451 properties that aggregate 17,2465 sites and are spread across 35 states.

10-K

Equity Lifestyle differs from single-family and multifamily REITs in that it leases the land to which tenants move their manufactured homes, RVs, or boats. The REIT provides value to an underserved segment since it’s generally cheaper to build MHs or buy RVs and lease the land you move them to instead of buying single-family homes. For this reason, it can be seen as competing with the housing market and single-family rental market, as it’s a cheaper alternative to both. However, the portfolio is mostly located in vacation destinations, so it mostly attracts retirees and vacationing families. The elderly population and longer-staying traveller focus is also indicated by the inclusion of clubhouses in many of the properties that offer various recreation and social activity amenities.

As far as permanent residents are concerned, the high cost of moving the property elsewhere provides Equity Lifestyle with a mostly stable revenue source. It would also be a mistake to think that because it also attracts residents who are on vacation for longer than usual, it’s close to lodging REITs as 90% of the company’s revenue comes from annual leases.

Performance

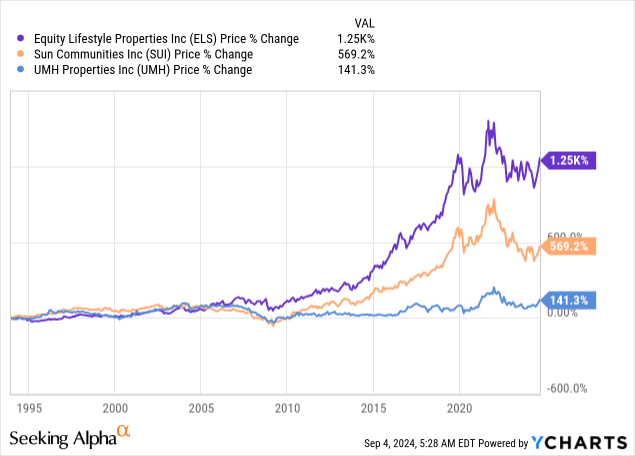

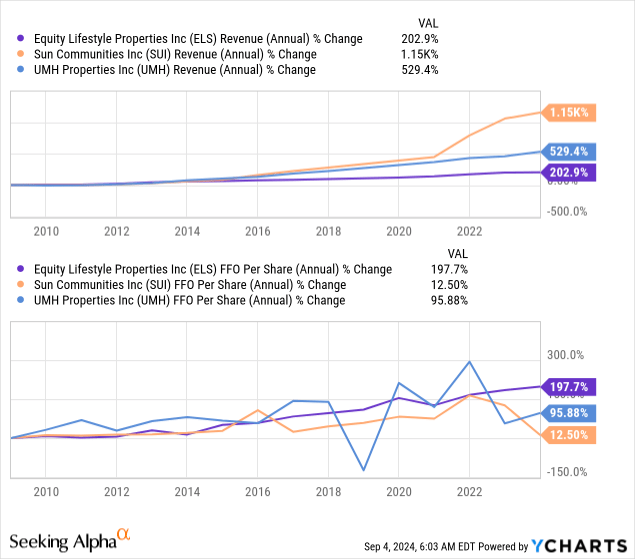

Using the price performance as an indicator of operating in markets with adequate expansion opportunities and successful capital deployment to take advantage of such opportunities, it’s safe to say that Equity Lifestyle is the best REIT in its sub-sector. It has been outperforming its peers for the past two decades by a great margin:

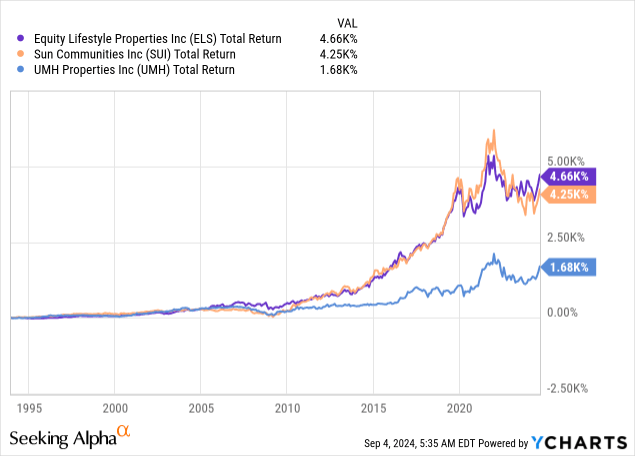

However, using its total returns as a measure of value delivery, its performance is as good as Sun Communities’ (SUI), while still outperforming UMH Properties’ (UMH) by a large margin:

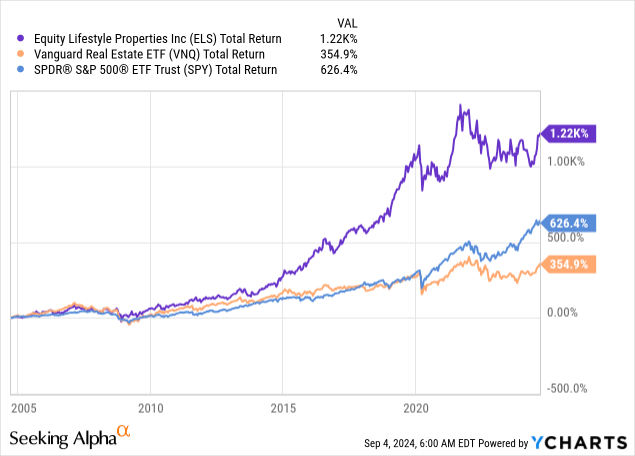

Regardless, its long-term performance is still exceptionally good, and it has also been beating the real estate equity market and broader U.S. market for a long time:

Although its pace of revenue growth doesn’t provide a likely explanation for its peer-relative outperformance, its FFO growth does as its FFO per share hasn’t only tripled in the long run, but the growth was relatively less volatile:

More recent results support the bullish case for this REIT as in 2023 ELS’ monthly base rental income per site in its core portfolio increased by 7% YoY and its occupancy rate only decreased by 20 bps to 94.9%. Although its last quarterly results indicate a deceleration in the rent growth as the rental rate’s YoY change was 5.96%, that’s still persistently high. Also, the average occupancy for the core portfolio was 94.9% in the last quarter, 10 bps higher than the same period a year ago and unchanged since the 2023 year-end.

Cash NOI for the year 2023 after excluding gains/losses from the sale of properties and other income was 5.31% higher than it was the year before, and normalized FFO per share increased by 4.7% YoY. Predictably, NOI in 2Q24 was 4.85% higher YoY and normalized FFO increased by 2.9%; the slower pace being consistent with decelerating rent growth.

That being said, during the last earnings call, management guided higher by raising its projections for normalized FFO to $2.91 at the midpoint. For comparison, normalized FFO per share was $2.75 in 2023.

Leverage & Liquidity

Equity Lifestyle is financing 61.49% of its assets with debt consisting of mortgage notes, term loans, and an unsecured line of credit. Its Debt to EBITDAre ratio is 5.37x and interest coverage is 4.49x (the weighted average interest rate is 3.7%), indicating more than adequate liquidity.

Its strong solvency profile is also reflected in the fact that its available liquidity is about 15% of total debt. Moreover, there are no maturities in 2024 and the following years up to 2033 don’t involve amounts coming due that are more than 10% of total debt. For these reasons, I believe that shareholders are not exposed to a lot of solvency risk here.

Dividend & Valuation

ELS currently pays a quarterly dividend of $0.48 per share, suggesting a yield of 2.67%. With a payout ratio of 65.97% and a dividend growth rate of 12.40% in the last 10 years, I see the dividend profile here as appropriate for conservative income portfolios.

Regardless, the dividend yield is way too low for a REIT and growth prospects shouldn’t outweigh this fact. For the risk you take as far as common shares are concerned, you should demand something better than 2.67%. At the same time, it’s reflective of how overvalued the REIT is; for comparison, the sector median yield is 4.33%. The normalized FFO yield of ELS is also 4.05%, indicating no justified potential outperformance in the near term.

Unsurprisingly, ELS wasn’t punished as much by the market after interest rates started climbing in 2022 as other REITs were, and that explains the current valuation:

TrendSpider

Among its peers, the share price is also quite high on an FFO per-share basis, having the highest FFO multiple.

| Stock | P/FFO |

| ELS | 24.71 |

| SUI | 19.03 |

| UMH | 20.75 |

| Average | 19.89 |

Risks

So, the most significant risk comes from overvaluation and decelerating rent growth. If interest rates are decreased, the demand for renting could soften and the growth that the market probably expects may not continue. A lower price is possible, but just the scenario that it stays more or less flat for a prolonged period is enough to make ELS unattractive, as shareholders would incur an opportunity cost.

It certainly doesn’t help that the dividend yield is so low, which will likely not be enough to offset such a cost.

There is also the risk that interest rates are going to remain that high for longer than the market anticipates, in which case, the price could face more pressure in the short term.

Verdict

As I see it, there is no strong bullish case for ELS right now, so I am rating it a hold. But because it has a solid track record of growth, strong liquidity, and an attractive portfolio in a niche market, I would rethink my position if it ever drops to a more attractive level as compared to its peers, potentially resulting in a more attractive dividend yield (4-5%).

What do you think? Do you own this stock or do you favor some other residential REIT? I’d love to know! Also, please leave a comment if you found this post useful; it means a lot. Thanks for reading.

Read the full article here