Overview

Cohen & Steers Closed End Opportunity Fund (NYSE:FOF) has a very consistent track record of providing distributions while maintaining the same price range over the last decade. This is what caught my attention as I love finding sources of reliable distribution income that helps support a stress-free investing experience for long term holders. FOF operates as a closed end fund that has the objective of achieving a total return comprised of both high current income and capital appreciation through its portfolio of investments. The fund has been around for some time and has an inception dating back to 2006. FOF was a bit unlucky and launched prior to the Great Financial Crisis so its beginning looks a bit rough.

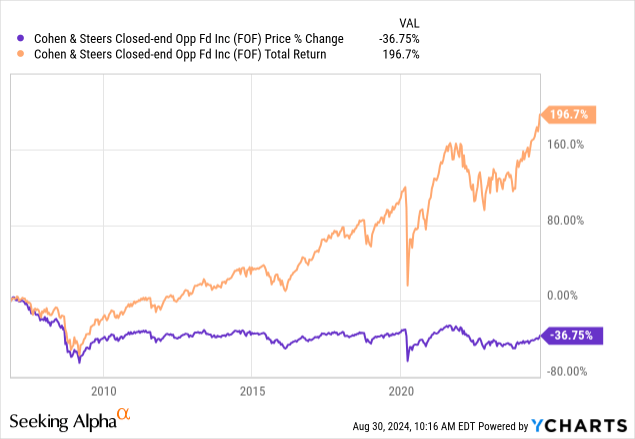

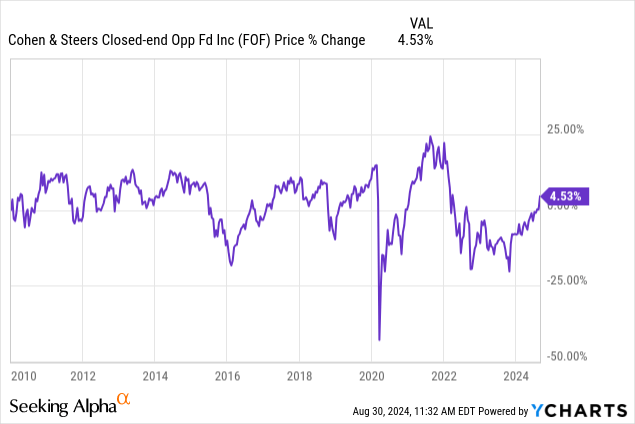

We can see that the price since inception has fallen by about 36.7% but this is only due to the initial drop following the GFC. After the price recovery following 2010, the price remained pretty stable and in the same trading range year after year. Despite this price performance, FOF has returned long term shareholders with a total return approaching 200% when including distributions. The current dividend yield sits at 8.3% and makes FOF an attractive pick for income focused investors. An added bonus is that the distribution is paid out on a monthly basis which adds some flexibility for income investors.

FOF currently has approximately $330M in managed assets and sports a reasonable 0.95% expense ratio. Something that stood out to me is that FOF maintains an extraordinary level of sector diversity across the market while also still exposing shareholders to some tech holdings. This is done by the fund’s unique approach of blending a mix of common stock and other closed end funds as part of their portfolio. In terms of valuation, the fund does admittedly seem a bit expensive at the moment, but I believe this is due to the strong performance during a period of higher interest rates.

Portfolio Strategy

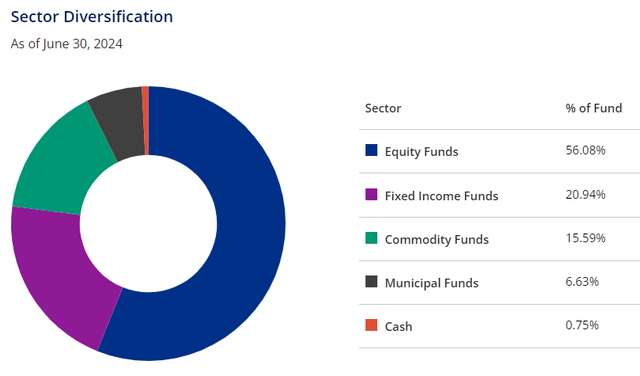

FOF maintains a blended approach that holds a majority exposure to equity funds, accounting for 56% of net assets. This is accompanied by exposure to fixed income funds and commodity funds, accounting for approximately 20.94% and 15.59% respectively. The most recent full list of holdings shows a wide variety of funds included, and I do like that it mixes in the simple with the more complex. For instance, FOF maintains exposure to a simple Vanguard S&P 500 ETF (VOO) while simultaneously having exposure to a complex fund like Guggenheim Strategic Opportunities Fund (GOF). This way, FOF is exposed to the best of both worlds and can experience price appreciation while also pulling in high amounts of income.

Cohen & Steers

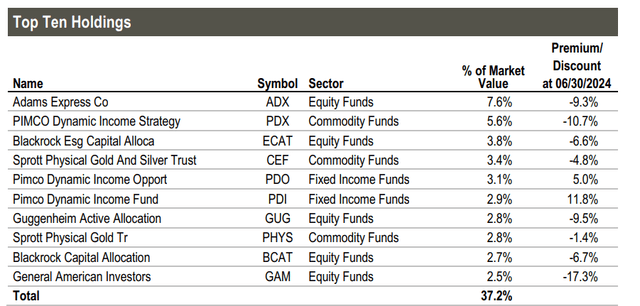

The fund is exposed to about 18 different sectors and contains 98 holdings throughout. According to the fact sheet, the top ten holdings account for 37.2% of total assets. The largest holding is Adams Express Co (ADX) which accounts for 7.6% of the portfolio. This is followed by a 5.6% weight in PIMCO Dynamic Income Strategy (PDX) and a 3.8% weight in BlackRock ESG Capital Allocation Fund (ECAT).

FOF Fact Sheet

Despite the mix of equities in the portfolio, I wouldn’t expect FOF to provide any meaningful capital appreciation over the long term. This is because the underlying weight in different closed end funds that are focused on income cancels out any growth from the equities. Closed end funds are typically known for their income producing abilities, and there are a very slim amount of these vehicles that experience long-term price appreciation on a consistent basis. Therefore, FOF is best utilized as an income asset in your portfolio.

Long-Term Performance & Valuation

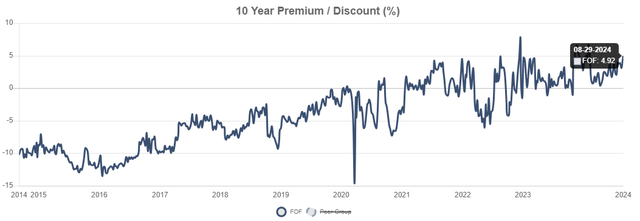

Since FOF operates as a closed end fund, the price can vary from the actual value of the underlying assets. As a result, we can see that FOF currently trades at a modest premium to NAV of 4.92%. For reference, the price has traded at an average premium to NAV of only 1.20% over the last three-year period. Therefore, FOF seems a bit expensive at the moment and this is not the most ideal time for entry from a traditional outlook. However, I believe that this premium is a bit justified when looking at the long-term performance and consistency of the fund.

Price To NAV Chart (CEF Data)

As previously mentioned, the price of FOF remained within a consistent trading range for over a decade. While there were dramatic market reactions during specific time periods over the last decade, the price has always seemed to recover. I input the below table to show a time frame between Jan 1st of 2010 to present day, and we can see that the price has ultimately ended up at a very modest 4.53% gain. For income investors, this consistent price range is very valuable because it grants us the ability to essentially collect the annual distribution rate with very little change to our invested capital balance.

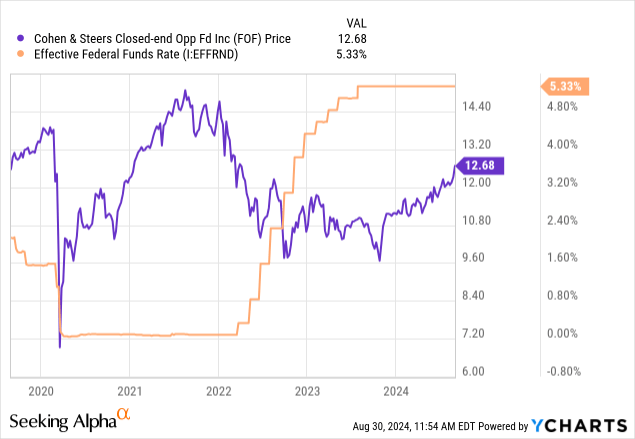

Since the underlying portfolio of investments also includes some fixed income assets, FOF does have a bit of sensitivity to interest rate fluctuations. For instance, when rates were cut to near zero levels following the pandemic in 2020, FOF’s price rapidly increased as this created a more favorable environment for these income-based investments. Near zero rates created an environment that made it more attractive for borrowers to take on debt, as it was now more affordable to do so. Lenders were able to capitalize on this by taking advantage of the higher volume of borrowers in the market.

Conversely, when interest rates were aggressively hiked throughout 2022 and 2023, the price of FOF retracted to the downside. As it becomes more expensive to take on new debt and hold it on the balance sheet, we started to see valuations fall. Despite the current premium to NAV, I believe that this could be an opportune time for accumulating shares before rate cuts take place. Markets seem to anticipate rate cuts happening in September, based on the Fed’s most recent statements and a combination of economic data. This could be a positive price catalyst that boosts FOF back above $13 per share.

Additionally, the consistent range can make it a bit more clear on timing what makes for a good entry versus what doesn’t. If you reference the price versus NAV chart, we can see that the discount has continually decreased over the last decade and trended towards the premium territory. When a closed end fund sees this sort of trajectory in a price to NAV relationship, it’s usually a good indicator of growth within the fund’s portfolio or earnings. This prompted me to take a look at the most recent 2023 annual report to look at the performance.

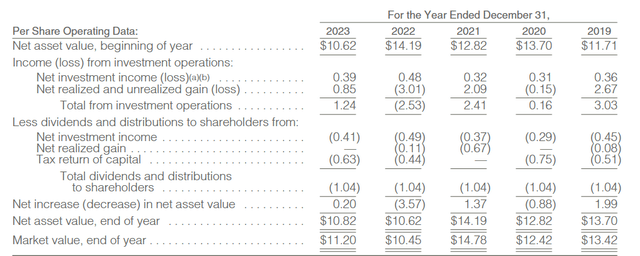

We can see that the total NAV for the ending of 2023 landed at $10.82 per share. This was a decrease from the prior total in 2019 of $13.70 per share. This was likely driven by the large loss in total investment operations in 2022, amounting to ($2.53) per share from large realized losses within the portfolio. However, most market indices were down that year, so this comes as no surprise. We can see that the growth of the NAV is supported by a combination of net investment income and realized gains.

FOF Annual Report

With the exception of 2020 and 2022, the fund has been able to cover the distribution with earnings. FOF is able to retain earnings from stronger years and use that buffer to help make up for any shortcomings in earnings during following years. However, it looks like the trade-off is that the distribution has to be made up of some return of capital during those weaker years when the fund isn’t able to generate sufficient realized gains, such as in 2020.

Dividend

As of the latest declared monthly dividend of $0.087 per share, the current dividend yield sits at 8.3%. What I like about FOF is that the dividend payouts have not been reduced over the last decade. The level of consistency here provides investors with stability in their income and, so far, has proven to be a great long-term choice. The fund has done extremely well by managing to retain the current payout rate through the pandemic, when many other funds were forced to reduce their distribution. The monthly addition of the divided adds to the appeal for retired investors that may depend on the supplemental income received to fund their lifestyle expenses.

Seeking Alpha

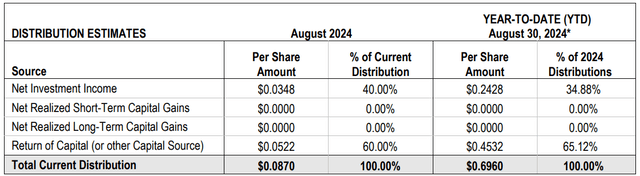

Despite the dividend not showing any meaningful growth, long-term investors would have still been able to grow their income year after year through a combination of dividend reinvestment and additional capital being invested. However, it should be noted that the majority of the distribution so far has been funded by return of capital. Return of capital may not necessarily be harmful if FOF manages to continue growing the NAV over time. Although, I’ll admit that I would’ve preferred to see that the distribution was funded primarily through a combination of net investment income and net realized gains.

I looked back at the most recent section 19a notice to get the exact breakdown of the distribution. On a YTD basis, we can see that net investment income only funded approximately 35% of the distribution, while the use of return of capital funded the remaining 35% of the distribution. This may indicate that the fund has struggled to show any meaningful growth in realized gains from the underlying holdings within. The annual reports are released at the end of the year in December, so I plan to check back in to see how the performance played out over the course of 2024. For now, I feel confident that the fund will be able to improve performance alongside the catalyst of interest rate cuts.

FOF Section 19a Notice

Investors should be aware that the distributions received from FOF can vary in terms of tax consequences. It’s all dependent on what the makeup of the distribution is and whether it was funded from net investment income or return of capital. The use of return of capital does have more favorable tax treatment, which can make it a versatile fund that can be utilized outside of tax advantaged accounts. However, the portions of the distributions that are funded by net investment income or realized gains may have tax consequences that we should be aware of.

Risk Profile

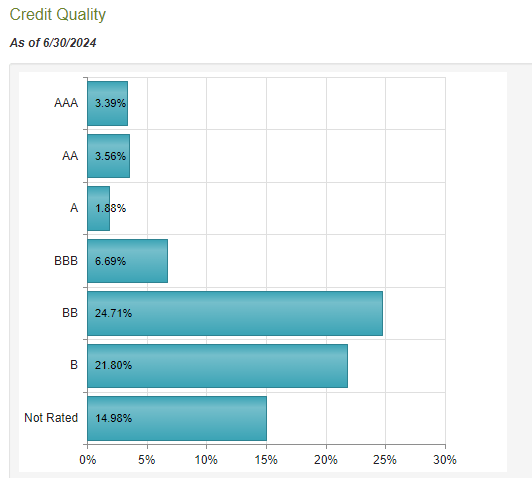

Investors should understand the level of risk that is involved with a fund like FOF. A lot of the vulnerabilities comes from the underlying exposure to different closed end funds that have portfolios that focus on investments with below investment grade credit ratings. In order to generate the higher yields that they do, a large percentage of these funds focus on holding investments that have poor credits ratings that are considered ‘junk’. Since it remains part of FOF’s top ten holdings, I will briefly use PIMCO Dynamic Income Strategy Fund (PDX) as an example.

PDX operates as a closed end fund that holdings exposure to equities and private credit investments. This can include a variety of debt-based investments, mortgage backed securities, and other high-yielding debt. As we can see, the credit quality of the portfolio lies in a majority exposure to assets that are below investment grade. For reference, anything rated below BBB is classified as below investment grade.

CEF Connect

This is just one of the funds in FOF that follow this structure. Since a lot of holdings have this kind of poor credit quality exposure, it leaves these income-based assets more vulnerable to interest rate fluctuations. If interest rates were to remain elevated for an even longer period of time, we could see a rise in defaults within their own respective portfolios. A rise in defaults would result in less earnings growth and potentially negative impacts to net investment income growth over time.

Takeaway

In conclusion, FOF remains a great choice for income investors that want some capital preservation and consistent distributions over a long period of time. FOF has maintained its streak of quality for over a decade, and the mixed portfolio of holdings will likely continue to contribute to this positive outlook. Since the underlying holdings are sensitive to fluctuations in the interest rate, this presents an opportunity as well as some risks. Future interest rate cuts an serve as a price catalyst for growth and boost the underlying NAV of holdings as it creates a more favorable environment for credit investments. Conversely, higher interest rates could put more strain on the portfolio of suppressed valuations. The distributions remain supported through a combination of net investment income and realized gains, but FOF has been using a bit of return of capital, which should continue to be monitored. For now, I rate FOF as an opportunistic buy as I believe interest rate cuts can serve as a positive catalyst.

Read the full article here