I am always on the lookout for new investment opportunities in the aerospace and defense industries, as I believe that there are significant opportunities to capitalize on favorable trends. The commercial airplane industry currently is facing aerospace supply chain challenges, but the long-term trend for air travel demand is focused upwards with higher production rates in prospect while demand for defense equipment remains elevated. Furthermore, commercializing of space and more space-based defense solutions provide significant opportunities for growth of space sectors. I am excited to expand my aerospace and defense coverage with LISI (OTCPK:LSIIF). Since this is the first time I cover the company, I will be providing a brief description of the company’s activities followed by a discussion of the most recent earnings, a risk assessment and a stock price target and rating.

LISI: Aerospace, Automotive And Medical

LISI, which stands for Link Solutions for Industry, was established in 1899 and focuses on supplying products to the aerospace, automotive and medical end markets. The company has a market capitalization of $1.43 billion and posted revenues of $1.80 billion in 2023. The company derives 52% of its sales from aerospace, 37% from automotive and 11% from the medical market. The combination of automotive and aerospace makes sense, but the combination of those end markets with the medical end-market might seem somewhat puzzling. However, having studied Aerospace Engineering with a minor in MedTech Based Entrepreneurship, I can say that there are many similarities between the medical and automotive and aerospace markets in terms of required competences.

The aerospace segment provides a wide variety of parts such as fasteners and engine components and has all the industry’s main players such as Boeing, Airbus, Embraer, Dassault, Spirit AeroSystems, MTU Aero Engines and Safran in its customer portfolio. For the automotive industry the company provides cable channels, sealing screws, guide pins and electronic parking brakes for company such as BMW, Mercedes, GM, Stellantis and Volkswagen while the Medical segment provides stablers and hip protheses and has companies such as Johnson & Johnson, Medtronic and Intuitive Surgical in the customer portfolio.

LISI Posts Higher Sales And Earnings But Demand And Supply Challenges Show

LISI

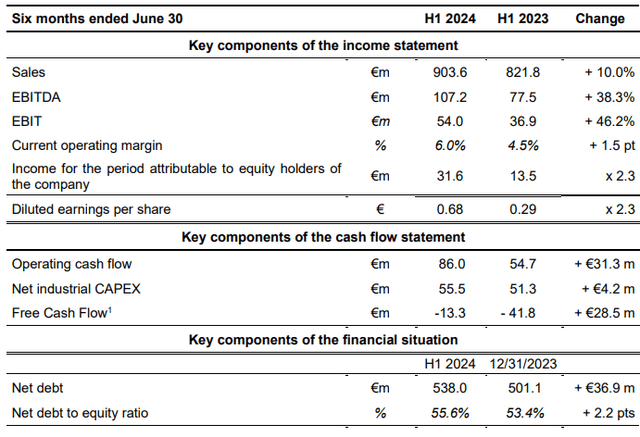

Total sales grew 10% to €903.6 million in H1 2024 while EBITDA grew 38.3% to €107.2 million with EBIT growing 46.2% to €54 million, indicating a margin increase of 1.5 points to 6%. We also saw cash flows improving, providing an indication that the aerospace supply chain, at least for LISI, is improving somewhat, requiring less inventory build.

Aerospace sales grew by 22% on higher order levels, primarily for single aisle airplanes and increased maintenance activities. The company did not provide an EBITDA margin for the segment but noted that EBITDA margins were up 4.7 points as productivity of newly hired staff is improving while volume increases allow for better cost absorption. Automotive sales declined 2.5%, but that still was better than the overall drop of 5.7% in production that LISI Automotive customers experienced. EBITDA increased from €25.9 million to €26.7 million, driven by cost control. The medical segment saw sales being 0.8% lower to €88.5 million. The main drivers of the stable revenues are a strong jump in sales in the comparable quarter last year, as well as difficulties sourcing raw materials. EBITDA of €13.1 million with margins of 14.8% compared unfavorably to €14.5 million and 16.3% in the same quarter last year.

So, while the company is active in key markets we do see aerospace supply issues that continue to be challenging, automotive demand is soft with a weaker second half expected while the first half of the year was a challenging one for the medical segment.

What Are The Risks And Opportunities For LISI?

The demand trends in aerospace are favorable, and that is a trend I believe to be favorable for the longer terms. Currently, the risk is the pressure in the aerospace supply chain. In the automotive industry, there is some pressure on certain manufacturers such as Volkswagen, which is a customer of LISI and that could impose a risk, while increased labor and material costs provide a risk for many companies active in the aerospace and automotive industries. While those costs are better under control, they remain a watch item.

LISI Offers An Attractive Investment Opportunity

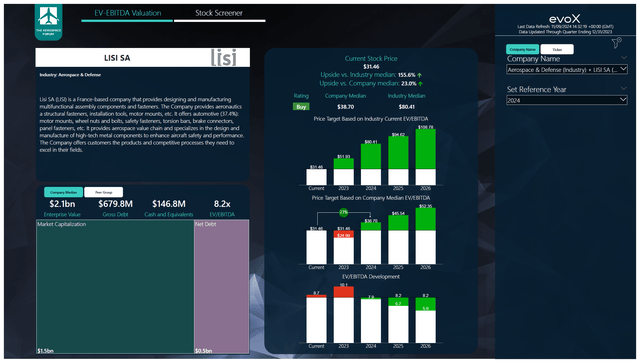

The Aerospace Forum

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

If you are interested in buying LISI stock, I have to note that the ticker LSIIF offers little volume, which leads to infrequent price making. So, if you are interested in purchasing the stock of the company, I do believe that the listing in Paris offers a better opportunity. Price targets are also set with the Paris listing in mind. EBITDA is expected to grow by 13.3% annually, while free cash flow growth is set to grow from $41.9 million in 2023 to $93.8 million in 2026. That makes quite a compelling investment opportunity as it would imply that against 2024 earnings there is 23% upside with even stronger upside in the years ahead, making LISI an attractive longer-term investment opportunity.

Conclusion: LISI Faces Some Challenges, But There Is Upside

The first half results showed that there are some transient pressures faced in several end markets, either due to demand softening or due to challenges in procuring raw materials. However, the longer-term trends, especially in aerospace, are strong, and the current valuation is appealing as there remains upside in the years ahead while the stock is significantly undervalued compared to sector peers which would also open up opportunities for the stock prices to increase due to expansion of the EV/EBITDA multiples in line with the peer group.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here