Dear readers/subscribers,

In my last article, about 2 months back, I looked at the REIT National Storage (NYSE:NSA) and gave the company a continued positive rating with a “Buy”. Today, I’m going to change that rating as I believe the company has reached what upside it could and might be here.

This is not to say that NSA is a bad company, but it can no longer be considered a buyable company. What upside remains in the company at this point is dictated by the valuation it could reach – and while the company does have the historical support of a valuation level that is in excess of this one, I say that there is no reason, based on things like earnings growth and FFO growth, that it should rise to these levels.

I believed the company was undervalued a year ago and more, and successfully bought plenty of shares at an attractive valuation. My position in NSA has yielded respectable returns, and the latest 10% return in less than 3 months is another feather in the cap for this particular investment.

But the time for buying is over. Now it’s time to enjoy that 6%+ yield that happens to be my dividend base for the company and this investment.

It goes to show you that as long as there is quality, there’s plenty to like about a good company at a great price (as opposed to requiring a “great” company at just a good price – this is one instance where my opinion differs from that of Warren Buffet).

NSA – Plenty to like about an upside if cheap – but it’s no longer cheap

So, I’ve covered this company for you a few times before. NSA has been in the midst of a re-orientation of its portfolio and balance sheet, and trying to properly position itself for 2025E and forward. This includes non-core sales as I have reported on before, of no less than 71 assets, and drive operational efficiencies. NSA has always been a bit more mixed in quality compared to Public Storage (PSA), which is by far a larger stake for me in my portfolio.

NSA has created a new JV including 56 assets, trying here to generate balance sheet initiatives in a way that allows for better funding for CaPEx and expansion. The new JV for 2023 also shows more buying power for the company. JV’s are of course a mixed bag. It means risk diversification, but income diworsification. This shows very clearly in the company’s near-term future prospects, and we need to consider this when we value NSA – because I believe this is not something the market is accounting for here.

I believe the market is “flying high” on the back of the company’s fundamental improvements, without seeing the downside. Also, it is backed by further buybacks to the tune of 18.2M shares since 2022, which comes to over $675M in “support” for the company’s valuation. This comes further to explain the significant upward boost the company’s valuation has received.

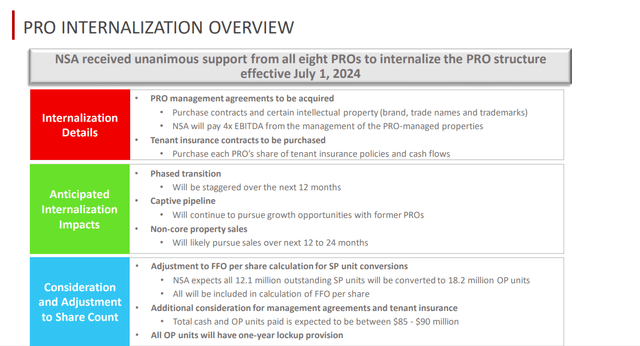

The company’s structure regarding PROs has been internalized here.

NSA IR (NSA IR)

Why is NSA doing this, exactly?

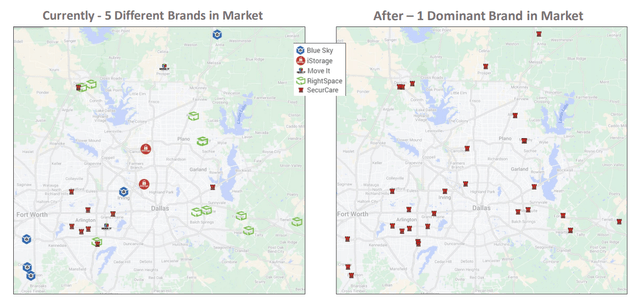

Well, the company is looking to secure a simplified overall structure and financials, generate some savings in G&A, increase brand flexibility, optimize the execution here, and expand the portfolio but with better financing and fundamentals. The recent move includes a shift from twelve large brands to seven larger brands as they are now. This consolidation has not only been done nationally but with clear targets in key areas. Take Dallas, TX, for instance.

NSA IR (NSA IR)

These sorts of moves have been done In a few places here. The company also has a history of successfully internalizing brands and companies here – with SecurCare, Northwest, and Move it, all of which were internalized in the past 4-5 years, at accretive FFO amounts, with good merger results, and a total of over 400 assets and properties across over 10 different states.

So, NSA knows what it is doing more than some would suggest here. And despite some of the major moves that this company (among others) has made, this remains a highly fragmented market to “play” in – which in turn means that there are non-trivial opportunities for consolidation here. NSA is at less than 2% of global market share – 66% of this industry remains in the hands of private operators, with only a 22% share in public hands. Plenty of opportunities here.

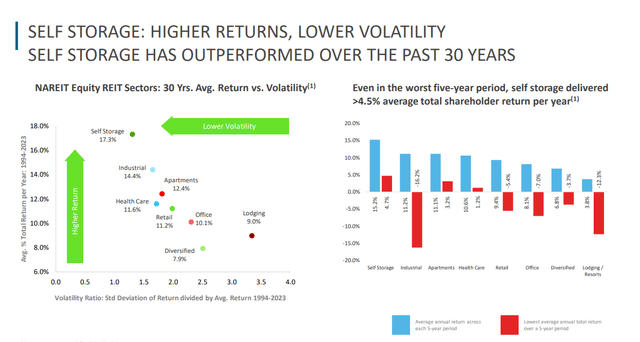

Despite some of the naysaying against self-storage, the industry has seen better trends than virtually everything else here – and remains very solid in terms of being an investable segment.

NSA IR (NSA IR)

The second quarter results are the latest ones we have here. We’re looking at a decrease of around 29% compared to the YoY period, with significantly lower diluted earnings in terms of net income. FFO is also down – 8.8% in terms of core FFO – and the reported occupancy is down 280 bps.

So what exactly is going on here, and why are things not working out for NSA? The company continued to M&A during the quarter and acquired a number of new properties. The explanation can, as expected, be found in ongoing internalization. The impact of asset sales is making itself known in the income statement. Proceeds are being used not only in buybacks or expansion, but lower debt with a target of the floating-rate debt that the company currently has.

But it’s not only that. There’s continued pressure on operating results, and the company’s management does characterize the current environment as very competitive. There’s less overall demand from the lower housing market and absorption of new supply, and this is felt most keenly in areas that are otherwise considered growth areas – namely sunbelt markets.

The company is also clear with the fact and expectation that these pressures will in fact remain for the remainder of the year. So, for the short term, I honestly don’t really understand why the company is up so much. In a way, it’s going “against the grain”, here because NSA is actually expected to see declines, not improvements, for the near term.

2023 came in at an FFO decline of 6%. 2024 is expected to come in at a decline of around 8% – so the decline is increasing. Even recovering in 2025E, the current expected recovery where I forecast something of a $2.35/share, is well below even the $2.69 the company managed during 2023, not to mention the $2.81+ it managed during 2022. And remember, during 2022, it traded well below the current share price level.

So again, the market is behaving illogically at times – and this is one of those times. I was certainly positive on NSA when it was cheap – but I am no longer positive here.

The current estimates turn out to be around $2.6/share for 2026E once the PRO structure is fully internalized and the company can start getting back to growth. That means I believe we’re likely to see continued pressure for at least 1–2 years unless something changes.

This means that the valuation is no longer favorable. Let me show you.

NSA – The upside here is lower than I expected

The thesis for 2024-2025 has materialized more since my last piece as well. More negatives and more issues are now expected for the company compared to my last piece.

Even if you were to allow this company its 5-10 year premium of 20x, that premium only gives us 11.4% inclusive of dividends here – and that isn’t enough to interest me. The company has higher debt than its peers, and there are far better options out there today. I didn’t change my PT of $50/share, and I’m not changing It here either. But note in that forecast that $50/share PT is for the 2025-2026E P/E. That means that the upside is lower today.

At $50/share, I’d start divesting NSA. At around $45/share, which is where we are today, I’m less interested, but I’m not divesting. Estimates at a more conservative valuation, which I’d remind you is entirely possible, come to around negative 0.82% per year inclusive of dividends.

We’ve reached an inflection point for NSA, as I see it. While 5% yield might interest some, it does not interest me, and I do not believe it should be enough as a sole argument to interest you either. I say that NSA is not buyable here, and I say that you should consider investing elsewhere, if in this sector. That being said, the entire industry is reaching high points of value. PSA is getting up there as well, with a share price of $333/share and a yield that’s now less than 3.6%. I’m up over 25% on PSA as well, and it’s approaching levels where I would consider being more careful.

I mentioned in my last piece that “analysts went sour very quickly” on NSA. , I have been clear that the company is worth more than $40/share. I continue to say that at below $40/share, this one is worth your consideration.

But at above or close to $45/share, what’s left here for you is the “scraps” of this meal, if we’re looking at this as an investment. And scraps are not enough for me, and shouldn’t be for you either.

For that reason, my thesis for NSA is as follows.

Thesis

-

NSA is the “smaller sibling” of market leaders like PSA. It operates in the same sector but has a better yield and more upside due to a more compressed overall valuation. However, valuation remains paramount to these businesses.

-

NSA may be a higher-risk/reward play than PSA and similar REITs, but it also would be unfair to characterize the company as a somehow “excessively risky” investment. Its portfolio and sector have outperformed for years, and I forecast the self-storage industry to make money for decades to come – there is little to suggest this is going away, even if it’s going down in growth. But now that it starts reporting drops in income and FFO, I expect it to become pressured – and would be careful investing here.

-

Based on this, I would call NSA a “Hold” with a PT of $50/share, but no more than that. I’m not changing my PT as of this article – but unless you’re okay with 9-11% annualized upside, I believe there are other investments with better upside out there.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I believe NSA fulfills several investment criteria I hold, but as of now, the company warrants a “Hold” rating due to no longer giving me 15% annualized, or anything close to it.

Read the full article here