Key takeaways Plan for success by building a business plan, putting together a budget and saving enough money to launch. Separate your business and personal finances by opening a business bank account and choosing business credit cards with useful benefits. Stay on top of your finances with…

Key takeaways Brand loyalty to certain credit cards or issuers can limit your rewards earning potential. Use multiple cards to maximize rewards rates, which might involve switching cards or using different cards for different types of spending. Understand the redemption options for each of your cards to get the most…

Key takeaways Both a line of credit and a credit card are types of revolving credit where you can borrow up to a certain amount and only pay interest on what you borrow. A line of credit typically has a lower APR and a higher credit limit than a credit…

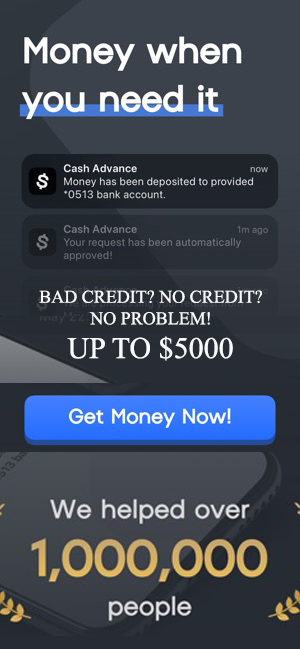

Key takeaways Lying on a credit card application is fraud and can have serious legal consequences. You shouldn’t need to lie to qualify for a credit card because there are cards available for all types of financial circumstances, including for those with poor or non-existent credit, as well as for…

Personal Finance

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many…

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

The Trump administration has been rapidly dismantling protections for student loan borrowers, leaving millions of Americans with diminishing options as…

Featured Articles

Key takeaways The typical mortgage payment doubled between 2020 and 2024, while today’s new homes are smaller than they have been in more than 10 years. Experts caution that home size isn’t always the best measure of value, especially in competitive markets with rising home…

Dept Managmnt

Key takeaways To pay off debt, you need to know how much you owe, how much you’re spending and where you can cut…

Banking

In my last column, I likened artificial intelligence to the wizard in “The Wizard of Oz.” It received a good reaction so I…

Credit Cards

All News

Annuities are often marketed as a retirement solution because they offer guaranteed income streams that can last a lifetime. However, there are several factors to consider whether an annuity is truly the “best” option. It depends on your financial situation, income needs, risk tolerance and long-term goals. For many, the…

Credit Sesame explains what student loan default means in 2025 and what resumed collections could mean for borrowers. What is happening in May 2025? Federal student loan payments officially resumed in October 2023, following a pause that began in March 2020. The U.S. Department of Education introduced a one-year on-ramp…

Keep reading for the latest nitty-gritty student loan research, including:Average Student Loan Debt StatisticsFederal Student Loan Debt StatisticsPrivate Student Loan Debt StatisticsStudent Loan Forgiveness StatisticsStudent Loan Debt Over TimeNegative Effects of Student Loan Debt Average Student Loan Debt Statistics Student loans are the second-largest debt in America behind mortgages.1 And as…

Did you know that according to the, “2025 Report on Employer Firms: Findings from the 2024 Small Business Credit Survey”, approximately 70% of small businesses in America are carrying some form of debt? It goes without saying that credit debt among all other debts can have a significant impact on…

I’ll never forget the weight of my $72,000 graduate student loan bill. It didn’t just affect my bank account — it shaped my daily spending choices, delayed my dreams and literally kept me up at night with anxiety, wondering if I’d ever truly feel free. At my lowest point, I…

Key takeaways Mutual funds can be a great way to invest for long-term goals such as retirement. There are thousands of mutual funds focused on different asset classes, such as stocks and bonds. Index funds are popular with investors for their low costs and diversification benefits. Millions of Americans use…

Key takeaways Several types of working capital loans can help cover short-term needs, including term loans, lines of credit, SBA loans and business credit cards. Some working capital loans come with higher interest rates than others. Compare options before making a decision. Long-term loans and business grants are alternatives to…

A nonrefundable tax credit can lower what you owe to the IRS, sometimes substantially but only to a point. Unlike refundable credits, nonrefundable credits cannot generate a refund if the credit amount exceeds your tax liability. That means if your total tax due is zero, the credit cannot push you…

Stocks tend to dominate financial headlines due to their volatility and potential for rapid gains or losses. But, bonds also play an important role by providing investors with stability and income. Both markets are large, and their size can change depending on the economy, interest rates and investor behavior. Knowing…

Credit Sesame’s personal finance news roundup May 10, 2025. Stories, news, politics and events impacting personal finance during the past week. Parents fuel gig economy spendingConsumer debt returns to growth in March 20251 in 5 student loans now seriously delinquentInternational travel to the U.S. drops 14%U.S. productivity declines for first…

Editor's Pick